Solid results in line with own expectations; strategy implementation on track

Emmi increased its sales by 1.1 % to CHF 3,494 million in 2019 and achieved pleasing, broad-based organic growth of 2.2 %. Earnings before interest and taxes (EBIT) improved by 0.5 % to CHF 218 million. At CHF 166 million, net profit was 5.3 % below the adjusted figure for the previous year, primarily as a result of a higher tax rate and higher minority interests. Sales and earnings are thus in line with Emmi’s forecasts and reflect the robustness, quality and balance of the company and product portfolio. Emmi continued to implement its strategy with conviction and consistency in 2019, advancing the business with a specific focus on growth markets, brands and the expansion of the strategic niches of desserts, organic products and goat’s milk. A dividend of CHF 12.00, CHF 3.00 higher than in the previous year, will be proposed to the General Meeting. This is a result of the revised dividend policy, which provides for an increase in the distribution rate to between 40 % and 50 % (previously 25 % to 30 %). For 2020, Emmi expects organic growth in line with its medium-term forecast (2 % to 3 %) and a further improvement in EBIT.

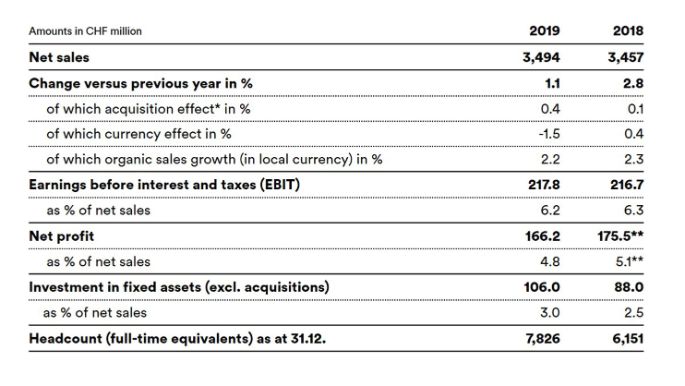

In the financial year 2019, Emmi generated net sales of CHF 3,494.0 million (previous year CHF 3,457.4 million), representing growth of 1.1 %. This is comprised of organic growth of 2.2 %, a positive acquisition effect of 0.4 % and a negative currency effect of -1.5 %. The pleasing organic growth of 2.2 % was broad-based across all business divisions and is in the upper third of the target range of 1.5 % to 2.5 %, after being revised downwards from 2 % to 3 % when the company reported its half-year results. Growth drivers included strategic niche markets such as Italian speciality desserts and goat’s milk products, branded products such as Emmi Caffè Latte and the growth markets of Latin America and North Africa.

EBIT amounted to CHF 217.8 million (previous year CHF 216.7 million) and is thus also within the range of communicated expectations. The EBIT margin was 6.2 % (previous year 6.3 %). This resulted in a net profit of CHF 166.2 million (previous year adjusted for the non-recurring effect from the sale of the minority stake in “siggi’s”: CHF 175.5 million). The net profit margin was therefore 4.8 % (previous year 5.1 % adjusted). There were two decisive factors behind this development: the increase in the tax rate from 13.7 % to 16.6 % and a significant rise in the minority interests due to their successful development that accounted for an increase from CHF 5.1 million to CHF 9.0 million.

Key figures

* Acquisition effects in sales are accounted for by the following factors:

+ Acquisition of blue cheese production site (US, 28 February 2019)

+ Acquisition of Leeb Biomilch GmbH and Hale GmbH (Austria, 8 October 2019)

+ Acquisition of Laticínios Porto Alegre Indústria e Comércio S.A. (Brazil, 24 October 2019)

+ Acquisition of Pasticceria Quadrifoglio S.r.l. (Italy, 31 October 2019)

- Sale of Emmi Frisch-Service AG (Switzerland, 3 April 2019)

- Disposal of part of the trading goods business (Switzerland, 1 January 2018)

**Adjusted for non-recurring effects. There were no significant non-recurring effects in the period under review. Non-recurring effects had an impact of CHF 57.8 million on net profit in the previous year, resulting from the sale of the minority stake in The Icelandic Milk and Skyr Corporation “siggi’s”.

Consistent implementation of strategy

Emmi took major steps forwards in the implementation of its strategy in 2019, further strengthening its position in growth markets outside of Europe and making investments in promising niches. The former was achieved in particular by increasing the stake in Laticínios Porto Alegre in Brazil and the merger of Surlat and Quillayes in Chile; both of them strengthened the Latin American business as well as the brand business. Measures boosting Emmi’s position in attractive strategic niche markets included the stake in Austrian goat’s and sheep’s milk processor Leeb, the acquisition of Italian dessert company Pasticceria Quadrifoglio and the purchase of the blue cheese production site in the US. Urs Riedener, CEO of the Emmi Group, commented: "We are generating solid revenue; thanks to our various acquisitions, we are poised to achieve major growth in 2020."

Sustainability as part of corporate philosophy

Emmi once again conducted an in-depth analysis of its sustainability objectives and associated measures in 2019. Significant progress was made, which paved the way for further development of the sustainability strategy. Alongside the ambitious targets for the four existing focus areas (greenhouse gases, milk, waste, employees), the strategy and objectives will also now cover water.

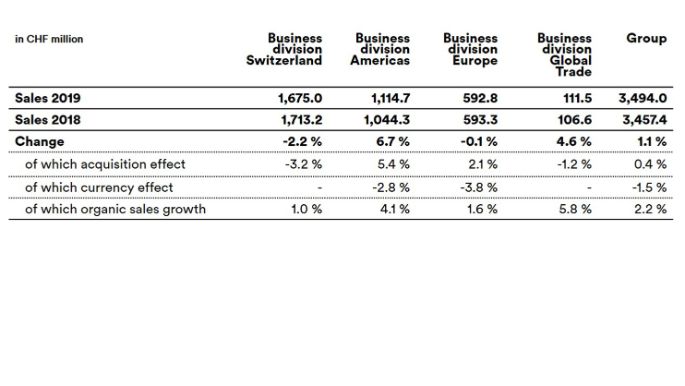

Sales performance

The following table provides an overview of sales performance by business division. More detailed information on Emmi’s sales performance in 2019 can be found in the media release dated 29 January 2020 or the Annual Report 2019.

Profit performance

Gross profit increased by CHF 13.7 million to CHF 1,266.6 million in the year under review (previous year CHF 1,252.9 million). This increase is due to strong organic growth and would have been considerably higher were it not for the overall negative currency effect. The gross profit margin rose from 36.2 % to 36.3 %.

After taking into account personnel expenses of CHF 462.4 million (previous year CHF 458.5 million), other operating expenses of CHF 458.3 million (previous year CHF 446.9 million) and other operating income of CHF 6.9 million (previous year CHF 5.3 million), earnings before interest, taxes, depreciation and amortisation (EBITDA) remained on a par with the previous year at CHF 352.9 million compared to CHF 352.8 million. The EBITDA margin contracted slightly as a result from 10.2 % last year to 10.1 % in the period under review.

After taking into account depreciation and amortisation of CHF 135.4 million (previous year CHF 136.4 million), earnings before interest and taxes (EBIT) amounted to CHF 217.8 million in the period under review, which was CHF 1.1 million or 0.5 % higher than the previous year’s EBIT of CHF 216.7 million. The EBIT margin decreased slightly from 6.3 % in the previous year to 6.2 % in 2019.

With a loss of CHF 1.1 million, income from associates and joint ventures remained at the level of the adjusted previous-year figure, while the financial result (net financial expenses) amounted to CHF 6.8 million (previous year CHF 6.5 million). Income taxes in the period under review amounted to CHF 34.8 million, representing an increase of CHF 6.2 million compared with the prior-year figure of CHF 28.6 million (adjusted for the “siggi’s effect”). The tax rate was thus 16.6 % (previous year, adjusted: 13.7 %). The higher tax rate is due in particular to tax claims capitalised in the previous year and a resulting very low tax rate. Profit including minority interests therefore came to CHF 175.2 million compared to CHF 238.3 million in the previous year. The previous-year profit including minority interests (adjusted for the “siggi’s effect”) amounted to CHF 180.5 million, putting it CHF 5.3 million above the profit including minority interests in the period under review.

The significant increase in minority interests from CHF 5.1 million in the previous year to CHF 9.0 million in the period under review is primarily attributable to the increased stakes in companies with minority interests in 2018, but also to the profitability improvements made in 2019.

Accordingly, net profit of CHF 166.2 million was reported for the period under review compared with CHF 175.5 million in the previous year (adjusted). As mentioned above, the main reasons for the fall in net profit were the very low tax rate in the previous year and the higher share of minority interests. The net profit margin fell from 5.1 % in the previous year (adjusted) to 4.8 % in the period under review.

New dividend and goodwill policy

The Board of Directors proposes that the General Meeting (2 April 2020) approve an increase in the dividend of CHF 3.00 or 33 % to CHF 12.00 per registered share. This significant increase is a result of Emmi’s revised dividend policy, as announced, which provides for an increase in the distribution rate to between 40 % and 50 % of net profit (previously 25 % to 30 %). Taking into account the revised consolidation and accounting principles for goodwill as of financial year 2020, this corresponds to a future distribution rate of between 35 % and 45 % of net profit. With regard to goodwill, Emmi has decided to change the method retroactively as of 1 January 2020 and thus apply it for the first time for the financial year 2020, and it will offset goodwill against equity. This method is already preferred by the clear majority of listed companies applying Swiss GAAP FER.

Outlook

In spite of various economic risks, positive consumer sentiment due to low levels of unemployment in many countries makes Emmi cautiously optimistic about future macroeconomic developments as they pertain to the company.

The considerable pressure exerted by imports and the price war in the retail trade will persist in Switzerland, and consumer tourism will remain a constant theme. Emmi’s goal is unchanged: to achieve stable to slightly higher organic sales in Switzerland through strong brand concepts.

Strong brands are also important success factors in business division Europe. While it is currently very difficult to assess the impact of Brexit on Europe as a whole and even though economic momentum in Europe remains weak, Emmi expects organic growth in the business division.

In business division Americas, demand in the US and Mexico is also expected to grow in 2020. Provided milk collection in Tunisia normalises and the social unrest in Chile abates, these markets can also be expected to provide a decisive boost to growth going forward. Brazil will significantly increase sales in business division Americas in 2020 but will only make a minor contribution to organic growth. The two European markets falling under business division Americas – Spain and France – will also impede sales performance.

Emmi is robust and well diversified. The defined strategy will continue to be pursued with conviction and consistency. Organic sales growth in line with medium-term forecasts should therefore be realistic for 2020 as well. The companies Emmi has recently acquired have opened up additional sources of revenue, although in the short term they will also generate acquisition costs. To support earnings, Emmi remains committed to its efficiency programme and will step this up in certain areas. Emmi expects earnings before interest and taxes (EBIT) to rise slightly overall at Group level in 2020. The net profit margin, on the other hand, is likely to fall slightly, due to an expected increase in the tax rate, higher financial expenses and rising minority interests as a consequence of the increasing profitability of our companies with minority shareholders. Emmi confirms its mid-term sales growth forecasts and the forecast for the net profit margin. The following forecasts for 2020 as well as the mid-term forecasts take into account the effects of the change in goodwill policy.

2020 forecasts

- Sales Group: 2 % to 3 %

- Sales business division Switzerland: 0 % to 1 %

- Sales business division Americas: 4 % to 6 %

- Sales business division Europe: 1 % to 3 %

- EBIT: CHF 255 to 265 million

- Net profit margin: 4.8 % to 5.3 %

Comment: Under the previous goodwill policy, the EBIT forecast would have been CHF 225 million to 235 million and the net profit margin would have been forecasted at 4.0 % to 4.5 %.

Medium-term forecasts

- Sales Group: 2 % to 3 %

- Sales business division Switzerland: 0 % to 1 %

- Sales business division Americas: 4 % to 6 %

- Sales business division Europe: 1 % to 3 %

- Net profit margin: 5.5 % to 6.0 %

Comment: Under the previous goodwill policy, the medium-term forecast for the net profit margin would have been maintained at 4.7 % to 5.2 %.

Interview with Urs Riedener on the Annual Results 2019

Marketing cookies necessary

Please accept the relevant cookie category to view this content

Contacts

Analysts:

Ricarda Demarmels, Group CFO | T +41 58 227 37 98 | ricarda.demarmels@emmi.com

Media:

Sibylle Umiker, Corporate Communications, Spokeperson | T +41 58 227 50 66 | media@emmi.com

About Emmi

Emmi is a major Swiss milk processor. The company dates back to 1907, when it was founded by 62 dairy farming cooperatives around Lucerne. Over the past 20 years, Emmi has grown into an international, listed group. It has for many years pursued a successful strategy based on three pillars: strengthening its Swiss domestic market, international growth and rigorous cost management. Throughout its corporate history, Emmi’s keen awareness of its responsibility to society, animal welfare and the environment has been fundamental to its mission.

In Switzerland, Emmi manufactures a comprehensive range of dairy products for its own brands and private label products for customers, including leading exports such as Emmi Caffè Latte and Kaltbach. In other countries, its products – mainly speciality products – are manufactured locally. Alongside cow’s milk, it also processes goat’s and sheep’s milk.

In Switzerland, the Emmi Group has 25 production sites. Abroad, Emmi and its subsidiaries have a presence in 14 countries, seven of which have production facilities. Emmi exports products from Switzerland to around 60 countries. Its business activities focus on the Swiss domestic market as well as Western Europe and the American continent. Half of its CHF 3.5 billion in sales – over 10 % of which stems from organic products – is generated in Switzerland, the other half abroad. More than two-thirds of its over 7,800 employees now work at locations outside of Switzerland.