Emmi records broad-based growth

Despite the global turmoil and negative foreign exchange trends, Emmi generated net sales of CHF 3,706.1 million and growth of 6.1 % in 2020. Organic growth was 1.9 %, confirming the robustness of Emmi’s business model, the well-balanced nature of the product and country portfolio, and the organisation’s adaptability. The Swiss business was the main contributor to growth in the first half of the year, whereas the foreign markets performed strongly in the second half. Brand concepts such as Emmi Caffè Latte and Kaltbach also posted gains during the crisis. In Switzerland, the increase in imported milk products had a negative effect on Emmi.

Highlights

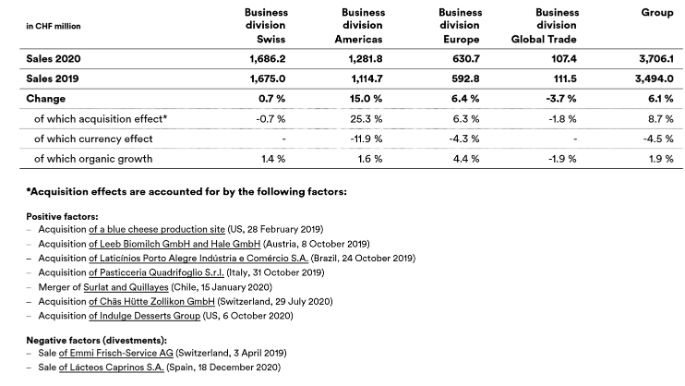

- Group sales enjoyed organic growth of 1.9 %, exceeding Emmi’s own forecast (0.5 % to 1.5 %); the acquisition effect was 8.7 % and the currency effect -4.5 %

- Solid sales growth in Switzerland, despite a below-average market performance by Swiss milk products in their home market

- Growth markets of Chile, Brazil and Tunisia made up for the Covid-related slowdown in the North American business within the Americas division

- Strong sales growth in key European markets thanks to good positioning of brand concepts and high demand for organic dairy products

- Strengthening of niche lines through acquisitions made in 2019

The earnings targets communicated in March 2020 and confirmed in August still apply. Emmi will publish its detailed results for 2020 and the outlook for the coming year on 2 March 2021.

Key sales figures

Summary

Emmi generated net sales of CHF 3,706.1 million in 2020. The growth of 6.1 % versus the previous year (CHF 3,494.0 million) is comprised of organic growth of 1.9 %, a positive acquisition effect of 8.7 % and a currency effect of -4.5 %. The organic growth of 1.9 % is above the range of 0.5 % to 1.5 % presented at the time of the half-year results release; this should be considered a positive result in view of the slightly negative overall impact of the coronavirus crisis on Emmi.

The trends that emerged in the first half of the year as the coronavirus rampaged continued in the second half. Globally, retail sales increased, whereas the food service business, convenience products and some branches of the food industry that are relevant for Emmi suffered massive falls.

Overall, organic sales growth rates were very similar in the first and second halves of the year. However, a detailed examination shows considerable geographical differences. In the first six months of the year, Emmi’s Swiss business enjoyed the sales-boosting effects of the coronavirus crisis; in the second half, however, the factors inhibiting sales dominated and the consistent trend towards imported dairy products over recent years intensified. Conversely, important growth markets such as Chile and Tunisia rallied and growth in Europe was strong, delivering major contributions to the Group’s sales growth.

The balancing effect of geographical diversification was not the only thing demonstrating the resilient nature of Emmi’s strategy in 2020, however. The years of work on selected brand concepts also bore fruit. Emmi Caffè Latte, for instance, enjoyed continued growth despite the tough conditions, while business with Swiss speciality cheeses – particularly Kaltbach – also supported growth in all business divisions. Emmi’s recent acquisitions have strengthened its position in the right markets and niches.

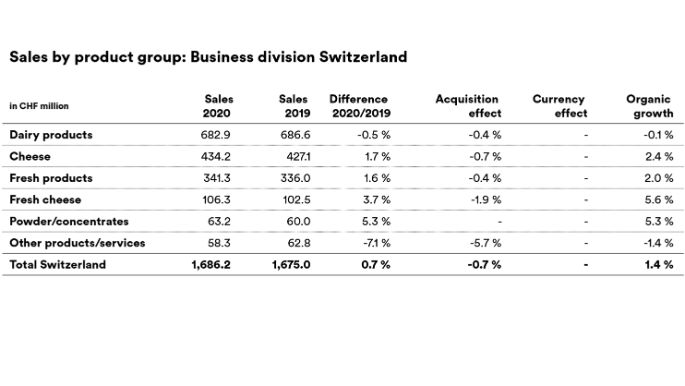

Business division Switzerland: healthy organic growth despite high import pressure and lockdowns for the hospitality industry

Sales in the business division Switzerland were CHF 1,686.2 million in 2020 (previous year: CHF 1,675.0 million). This corresponds to growth of 0.7 %. Adjusted for acquisition effects (primarily the sale of Emmi Frisch-Service AG to Transgourmet), the organic sales growth of 1.4 % was in line with Emmi’s expectations (1 % to 2 %). The only cautiously optimistic guidance issued despite the good results for the first half of 2020 proved realistic in light of the in some cases hugely negative impact of measures to tackle coronavirus. After a solid summer, sales in the food service and out-of-home consumption businesses, along with sales to certain industrial customers, came under pressure – massively so in some cases. Latent foreign competition was also a factor, and Swiss dairy products lost market share in 2020. The additional dairy product consumption in the retail business was largely met through imports, with consumers increasingly turning to imported products due to the temporary suspension of cross-border shopping.

The largest segment, dairy products (milk, cream, butter), recorded a small organic fall of 0.1 %. This came despite the segment being well into positive territory in the first half of the year thanks to Covid-related record sales in the retail business and a positive milk price effect. During the second half of the year, not only did retail demand normalise, but the impact of the coronavirus measures also fed through to the food service and industrial customers businesses.

In the cheese segment, the pleasing organic growth of 2.4 % was driven by additional sales of Le Gruyère AOP and strong brand concepts such as Kaltbach, Luzerner Rahmkäse, Scharfer Maxx and Le Petit Chevrier. A sizeable increase in cheese imports during the reporting period acted as a drag.

In the fresh products segment (organic growth: 2.0 %), Emmi Caffè Latte and Emmi Energy Milk performed particularly well. However, both convenience concepts were held back slightly in the second half of the year by the Covid-related reduction in mobility (e.g. remote teaching at universities). Yogurt and ice cream sales also contributed to the growth.

The encouraging trend in fresh cheese (organic growth: 5.6 %) was primarily attributable to the tremendous popularity of mozzarella in home cooking.

The Switzerland business division accounted for 45.5 % of Group sales (previous year: 47.9 %).

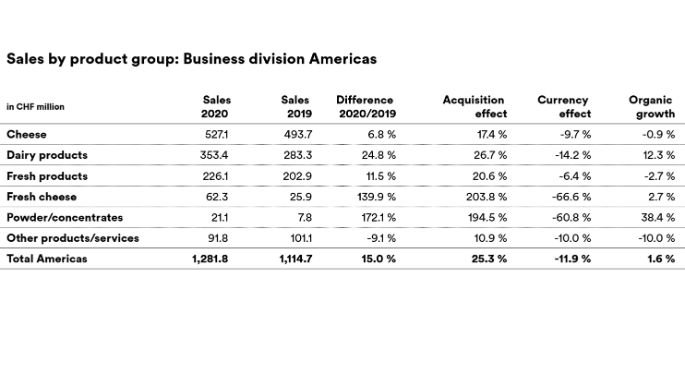

Business division Americas: Covid-related challenges in the food service business stifle growth

The business division Americas includes the Emmi Group companies in the US, Spain (excl. Lácteos Caprinos S.A.), Chile, Brazil, Tunisia, France, Mexico and Canada.

The business division Americas generated sales of CHF 1,281.8 million in 2020 (previous year: CHF 1,114.7 million). This 15.0 % increase was chiefly attributable to acquisition effects. The strongly negative currency effects related mainly to Central and South American currencies, and to a lesser extent to the US dollar and euro. Adjusted for these effects, organic growth was 1.6 %. This meant that sales recovered strongly in the business division that suffered most at the hands of the coronavirus crisis due to its large share of the food service business. The adjusted expectations issued midway through the year (-2 % to 0 %) were exceeded.

In the cheese segment, restrictions such as closures of sales outlets, cheese counters and restaurants imposed in response to the epidemic produced an organic fall in sales of 0.9 %. Under these circumstances, the increase in cheese exports from Switzerland to the US was extremely welcome.

As a consequence of coronavirus, Chile and Tunisia were largely responsible for both a major jump in demand for basic products, with a positive effect on the dairy products segment (organic growth: 12.3 %), and falls in the fresh products segment (organic growth: -2.7 %). Positive contributions there, e.g. from Brazil (entry into the yogurt business) could not fully make up for the lower sales in California and Spain. However, Emmi Caffè Latte posted pleasing growth in Spain despite the country being hit hard by coronavirus.

In the fresh cheese segment (organic growth: 2.7 %), the growth in Brazil and at Redwood Hill in California balanced out falls, again linked to the coronavirus pandemic, at Mexideli’s wholesale business.

The Americas business division accounted for 34.6 % of Group sales (previous year: 31.9 %).

Business division Europe: branded and organic products fuel sales growth

The business division Europe incorporates the Emmi Group companies in Germany, Italy, the Netherlands, the UK, Austria, Lácteos Caprinos in Spain (sold on 18 December 2020) and Belgium.

The business division Europe generated sales of CHF 630.7 million, up 6.4 % on the previous year’s figure of CHF 592.8 million. Adjusted for currency and acquisition effects, this resulted in strong organic growth of 4.4 %. As such, organic growth increased significantly again in the second half of the year, exceeding the Group’s own forecast of 1 % to 3 %.

The decisive growth drivers in the fresh products segment – the largest segment in terms of sales – were Emmi Caffè Latte in the UK, Austria and Germany, Italian speciality desserts and Onken yogurts (organic growth: 3.5 %).

Significantly higher sales of Kaltbach, fondue and Swiss cheese varieties in the Netherlands, Germany and the UK produced strong organic growth in the cheese segment (organic growth: 9.0 %).

The growth recorded in the dairy products segment (organic growth: 8.0 %) was primarily the result of coronavirus driving up demand for high-quality organic dairy products from Gläserne Molkerei in Germany.

The business division Europe accounted for 17.0 % of Group sales (previous year: 17.0 %).

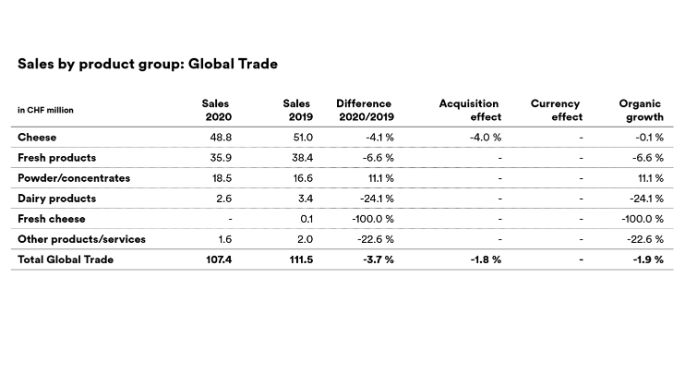

Business division Global Trade: Asian business down due to coronavirus

The business division Global Trade primarily comprises direct sales from Switzerland to customers in countries in which Emmi has no subsidiaries. These include the Asian and eastern European markets, most South American countries and the Arabian Peninsula.

Sales in the Global Trade business division were CHF 107.4 million, compared with CHF 111.5 million in 2019. In organic terms, sales were down by 1.9 %. This was principally due to lower hotel and flight capacity utilisation as a consequence of coronavirus. These restrictions in Asia had a particularly strong impact on fresh products (yogurts and yogurt drinks). The cheese segment trod water, as growth for Kaltbach almost entirely made up for lower fondue sales. The growth in the powder/concentrates segment reflects the rise in exports of surpluses in the form of skimmed-milk powder.

Global Trade accounted for 2.9 % of Group sales (previous year: 3.2 %).

Outlook

Emmi is standing by the earnings forecasts for 2020 that were communicated in March 2020 and confirmed in August. Emmi will release its detailed results and the sales and earnings guidance for 2021 on Tuesday 2 March 2021.

Downloads and further information

Contacts

Analysts

Ariane Scherzinger, Assistant to the CFO (coordination of enquiries)

T +41 58 227 27 20 | ir@emmi.com

Media

Sibylle Umiker, Corporate Communications, Spokesperson

T +41 58 227 50 66 | media@emmi.com

About Emmi

Emmi is a major Swiss milk processor. The company dates back to 1907, when it was founded by 62 dairy farming cooperatives around Lucerne. Over the past 20 years, Emmi has grown into an international, listed group (EMMN). It has for many years pursued a successful strategy based on three pillars: strengthening its Swiss domestic market, international growth and rigorous cost management. Throughout its corporate history, Emmi’s keen awareness of its responsibility to society, animal welfare and the environment has been fundamental to its mission.

In Switzerland, Emmi manufactures a comprehensive range of dairy products for its own brands and private label products for customers, including leading exports such as Emmi Caffè Latte and Kaltbach. In other countries, its products – mainly speciality products – are manufactured locally. Alongside cow’s milk, it also processes goat’s and sheep’s milk.

In Switzerland, the Emmi Group has 25 production sites. Abroad, Emmi and its subsidiaries have a presence in 14 countries, eight of which have production facilities. Emmi exports products from Switzerland to around 60 countries. Its business activities focus on the Swiss domestic market as well as Western Europe and the American continent. Roughly half of its CHF 3.7 billion in sales – around 10 % of which stems from organic products – is generated in Switzerland, the other half abroad. More than two-thirds of its nearly 8,700 employees now work at locations outside of Switzerland.