Emmi successfully defies the crisis

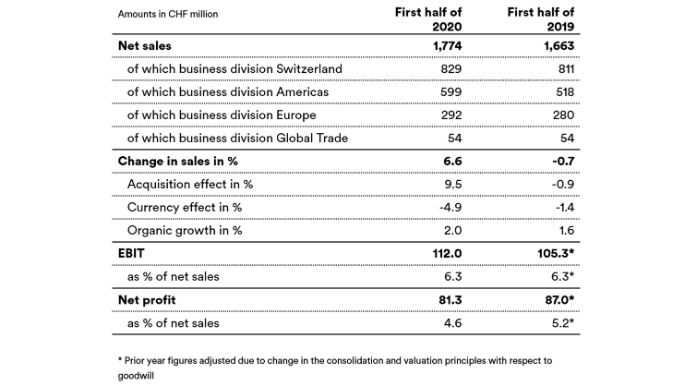

Lucerne, 26 August 2020 – Emmi increased sales by 6.6 % to CHF 1,773.5 million in the first six months of the financial year, which were characterised by the coronavirus crisis. The organic growth of 2.0 % achieved by the leading Swiss milk processor was driven in particular by a strong retail performance in the Swiss domestic market, key brand concepts such as Emmi Caffè Latte and sales in strategic niches. The slump in the food service sector triggered by the pandemic affected sales in the business division Americas in particular. EBIT improved by 6.4 % to CHF 112.0 million, while net profit was down by 6.5 % at CHF 81.3 million. Despite considerable uncertainty, Emmi remains cautiously optimistic for the full-year.

Key points in brief:

- Sales growth of 6.6 %; organic growth of 2.0 %; acquisition effect of 9.5 %; currency effect of -4.9 %

- Gross profit margin down from 36.4 % to 36.1 % due to the coronavirus

- EBIT of CHF 112.0 million, 6.4 % up from the prior year period; stable EBIT margin of 6.3 %

- Net profit down by 6.5 % to CHF 81.3 million, due mainly to an expected higher tax rate, financial expenses and minority interests; net profit margin of 4.6 %

- Share of milk processed in Switzerland and produced according to Swissmilk Green sustainability standard at 87 %

“Our business model has proven itself even under difficult conditions, backed by a diversified product and country portfolio, strong brands and an agile organisation. I am particularly pleased that we maintained supply at all times, not least thanks to the tireless commitment of our employees, and were thus able to deliver growth despite the extremely difficult environment,” says Urs Riedener, CEO of the Emmi Group.

Marketing cookies necessary

Please accept the relevant cookie category to view this content

Concerning sustainability, Emmi has been focusing on the four areas of waste, greenhouse gas reduction, employees and sustainable milk, which have been subject to specific and binding targets since 2016. Further progress was made in the first half of 2020. In Switzerland, Emmi now processes 87 % of its milk produced according to the Swissmilk Green sustainability standard, meeting growing demand from consumers and customers. With a reduction of 23 % compared to the base year 2014, it is also on track to deliver on its Group-wide greenhouse gas emission target. However, more efforts are needed in waste reduction to build on the 18 % decrease achieved in reducing food waste.

Key figures

The overall positive acquisition effect of 9.5 % is due to the following factors:

Positive impact:

- Acquisition of a blue cheese production facility (US, 28 February 2019)

- Acquisition of Leeb Biomilch GmbH and Hale GmbH (Austria, 8 October 2019)

- Acquisition of Laticínios Porto Alegre Indústria e Comércio S.A. (Brazil, 24 October 2019)

- Acquisition of Pasticceria Quadrifoglio S.r.l. (Italy, 31 October 2019)

- Merger with Quillayes (Chile, 15 January 2020)

Negative impact:

- Sale of Emmi Frisch-Service AG (Switzerland, 3 April 2019)

Internal shifts in the distribution channels of individual customers also led to acquisition or divestment effects in the business divisions Americas, Europe and Global Trade. However, these shifts between individual divisions had no impact on the Group.

Details of sales and earnings performance

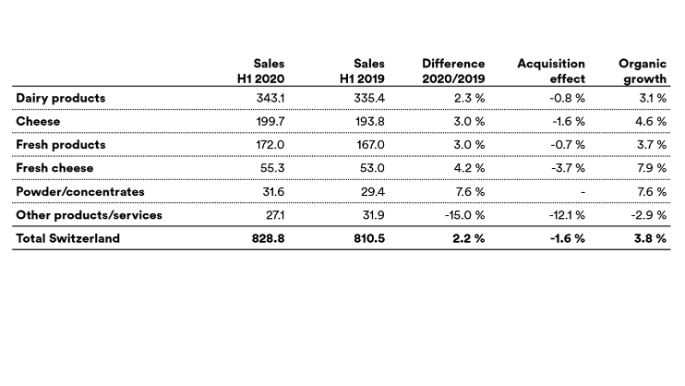

Sales business division Switzerland: Crisis bolsters retail sales

The business division Switzerland generated net sales of CHF 828.8 million, an overall increase of 2.2 % compared with the prior year figure of CHF 810.5 million. Adjusted for the adverse impact on sales from the disposal of Emmi Frisch-Service AG, organic growth was exceptionally high at 3.8 %. This is well above Emmi’s forecast of 0 % to 1 % for the full-year, driven in large part by the strong retail performance as a result of increased demand for domestic dairy products and the temporary drop-off in shopping tourism. The milk price trend likewise propped up organic growth.

The change in demand in the division manifested itself across all major segments. Dairy products are traditional fixtures of every breakfast table; cream, butter and grated cheese are common ingredients in cooking; or if you’re in a rush, a Caprese salad with mozzarella or a cheese plate are quick and delicious options. Traditional cheese varieties as well as speciality cheeses such as Kaltbach, Luzerner Rahmkäse, der Scharfe Maxx or Le Petit Chevrier proved popular additions to these platters. Especially noteworthy is the continued positive sales trend recorded by Emmi Caffè Latte.

Bucking the global downturn in convenience products, which came under pressure during the lockdown due to the sharp reduction in mobility, our signature chilled lattes were able to increase sales. The reasons for this are two-fold: on the one hand, consumers frequently treated themselves to a small reward while working at home during the crisis; and on the other, the good weather lured people outside – often with an Emmi Caffè Latte in their hands.

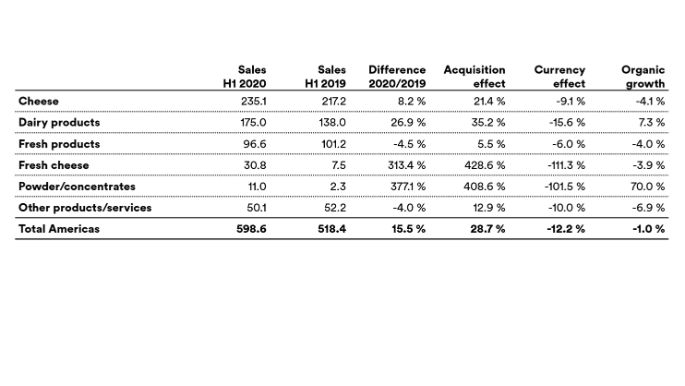

Sales business division Americas: Slump in the food service sector hampers sales performance

The business division Americas incorporates the Emmi Group companies in the US, Spain (excluding Lácteos Caprinos), Chile, Brazil, Tunisia, France, Mexico and Canada.

Sales in this business division Americas rose from CHF 518.4 million to CHF 598.6 million in the first half of 2020. The year-on-year growth of 15.5 % is mainly due to the acquisitions in Brazil and Chile. Adjusted for the strongly negative currency and major acquisition effects, organic sales declined by 1.0 %, well below the company’s full-year forecast of 4 % to 6 % growth.

The main driver of this negative development was the ongoing coronavirus crisis, which had by far the greatest adverse effect on the business division Americas due to its substantial share of sales in the food service sector – the highest in the Group. This is exemplified by the organic decline in sales in the Cheese segment. Cheeses produced locally in the US, including speciality cheeses from California, bore the brunt of this downturn as sales outlets, cheese counters and restaurants were forced to shutter. Swiss cheese (especially Kaltbach) was able to counteract this trend, posting growth. Dairy products also helped to improve the overall balance slightly.

The high organic growth is attributable in particular to Chile (milk and cream) and Tunisia (milk and butter). In Tunisia, higher demand for locally produced desserts also bolstered the Fresh products segment. However, the segment suffered from lower sales due to coronavirus, adversely affecting Italian speciality desserts in France, yogurts and milk drinks at Redwood Hill in California, and milk and yogurt drinks in Spain, Tunisia and Chile. Sales of Emmi Caffè Latte in Spain posted gains, by contrast.

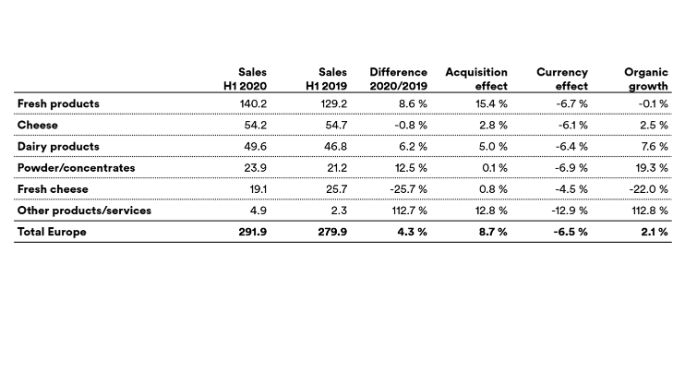

Sales business division Europe: Diversified portfolio pays off

The business division Europe incorporates the Emmi Group companies in Germany, Italy, the Netherlands, the UK, Austria, Lácteos Caprinos in Spain and Belgium.

In the first half of 2020, sales in the business division Europe amounted to CHF 291.9 million, compared with CHF 279.9 million in the same period last year. This resulted in overall growth of 4.3 %. Excluding acquisition and currency effects, this corresponds to organic growth of 2.1 %, which is in line with our projection for full-year 2020 (1 % to 3 %).

The markets in the business division Europe posted a similar trend to that in Switzerland, with the decline in fresh products, which are focused on convenience, offset by strong growth in dairy products and cheese. However, positive stimulus came from the Fresh products segment in the UK, where Onken yogurts and Emmi Caffè Latte posted gains. In the Cheese segment, higher exports of Swiss cheese to Italy and the Netherlands propped up organic growth. It was likewise pleasing to see Gläserne Molkerei in Germany return to growth on the back of its revised strategy, benefiting from the rise in demand for organic products. This is particularly reflected in the performance of the Dairy products segment.

A special feature of the business division Europe is the key role played by goat’s milk products. Given the high dependency on the food service industry, sales of goat’s cream cheese declined, although this was largely offset by higher sales of goat’s milk powder from the Netherlands.

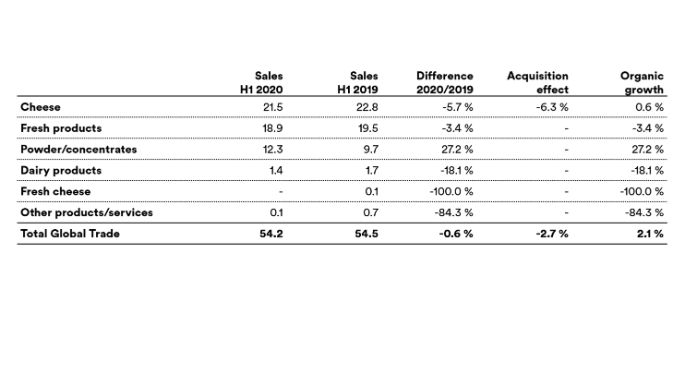

Sales business division Global Trade: Milk powder exports support growth

Business division Global Trade primarily comprises direct sales from Switzerland to customers in countries where Emmi has no subsidiaries. These include the Asian and eastern European markets, most South American countries and the Arabian Peninsula.

Sales in the business division Global Trade amounted to CHF 54.2 million in the first half of 2020, down 0.6 % on the prior year result of CHF 54.5 million. Adjusted for the negative acquisition effect, this represents organic growth of 2.1 %.

The key contributing factors here were higher sales of natural cheese (including Kaltbach) and significantly increased skimmed milk powder exports, offset by the decline in sales of yogurts and yogurt drinks in the Asian region.

Detailed explanations of the sales performance can be found in the Emmi half-year report 2020.

Stable EBIT margin

Gross profit amounted to CHF 639.9 million in the reporting period. This constitutes an increase of CHF 35.0 million on the prior year with CHF 604.9 million. The gross profit margin fell from 36.4 % to 36.1 %, depressed by the change in the mix due to the coronavirus crisis at the expense of high-margin products combined with adverse foreign currency effects. The consistent implementation of rationalisation and productivity boosting measures and strong brand concepts such as Emmi Caffè Latte had a positive, stabilising effect.

Operating expenses rose by CHF 26.8 million to CHF 473.8 million (previous year: CHF 447.0 million). In relation to net sales, however, they fell from 26.9 % to 26.7 %.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) increased by CHF 8.5 million in the period under review to CHF 168.1 million, up from CHF 159.6 million in the first half of 2019. The EBITDA margin therefore amounted to 9.5 %, compared with 9.6 % in the same period last year. The shortfall at the level of the gross profit margin was thus largely offset by the fact that the rise in operating expenses was kept relatively low. Higher depreciation coupled by a simultaneous slight decline in amortisation largely cancelled each other out.

Earnings before interest and taxes (EBIT) were CHF 112.0 million in the period under review, down CHF 6.7 million or a good 6.4 % on prior year EBIT (CHF 105.3 million). The EBIT margin remained stable compared with the same period last year, at 6.3 %.

As expected, net profit was impacted by lower pro rata profits from associates, rising financial and tax expenses, and higher minority interests. This amounted to CHF 81.3 million in the period under review compared with CHF 87.0 million in the prior-year period, representing a decline of CHF 5.7 million or 6.5 %. The net profit margin was 4.6 % (previous year: 5.2 %). Earnings per share also fell slightly as a result, down to CHF 15.20 at the end of the first half of the year (previous year: CHF 16.25).

Outlook for full-year 2020

In the first half of 2020, Emmi once again demonstrated that it is on a very solid ground. Supported by its broadly diversified portfolio and mix of countries, categories and sales channels, the company has so far defied the coronavirus crisis. Given the persistent uncertainties surrounding the future course of the coronavirus pandemic and the associated macroeconomic developments, the outlook for the second half of the year remains uncertain. Moreover, there are currently no signs of recovery in those markets that have been severely affected by the pandemic and are important for Emmi, such as the US, Brazil, Mexico and Chile. Worldwide, consumer confidence is languishing at a low level and recessionary economic trends are already a fact in most countries. Added to this, the positive non-recurring effects in the first half of the year will no longer apply in the second half, and it will likely take several years for certain sales channels to stage a sustained recovery.

Emmi is preparing for a continued volatile and highly competitive environment in the second half of 2020, but remains cautiously optimistic about the result for the full-year.

- Full-year sales forecast for 2020 (assuming the pandemic stabilises):

- Organic sales development Group: 0.5 % to 1.5 % (previously 2 % to 3 %)

- Organic sales development Switzerland: 1 % to 2 % (previously 0 % to 1 %)

- Organic sales development Americas: -2 % to 0 % (previously 4 % to 6 %)

- Organic sales development Europe: 1 % to 3 % (no change)

We consider the EBIT forecast of CHF 255 million to CHF 265 million for full-year 2020 to be extremely ambitious, but still within grasp if the recovery remains intact. Accordingly, from today’s perspective, EBIT is expected to be at the lower end of the range indicated above. We are reiterating our original forecast for the net profit margin (4.8 % to 5.3 %).

Downloads and further information

Contacts

Analysts:

Ricarda Demarmels, Group CFO | T +41 58 227 37 98 | ricarda.demarmels@emmi.com

Media:

Sibylle Umiker, Corporate Communications, Head of Media Relations | T +41 58 227 50 66 | media@emmi.com

About Emmi

Emmi is a major Swiss milk processor. The company dates back to 1907, when it was founded by 62 dairy farming cooperatives around Lucerne. Over the past 20 years, Emmi has grown into an international, listed group. It has for many years pursued a successful strategy based on three pillars: strengthening its Swiss domestic market, international growth and rigorous cost management. Throughout its corporate history, Emmi’s keen awareness of its responsibility to society, animal welfare and the environment has been fundamental to its mission.

In Switzerland, Emmi manufactures a comprehensive range of dairy products for its own brands and private label products for customers, including leading exports such as Emmi Caffè Latte and Kaltbach. In other countries, its products – mainly speciality products – are manufactured locally. Alongside cow’s milk, it also processes goat’s and sheep’s milk.

In Switzerland, the Emmi Group has 25 production sites. Abroad, Emmi and its subsidiaries have a presence in 14 countries, eight of which have production facilities. Emmi exports products from Switzerland to around 60 countries. Its business activities focus on the Swiss domestic market as well as western Europe and the American continent. Half of its CHF 3.5 billion in sales – over 10 % of which stems from organic products – is generated in Switzerland, the other half abroad. Two-thirds of its more than 8,000 employees are currently based outside of Switzerland.