Emmi with consistently positive performance

Ad hoc announcement pursuant to Art. 53 LR

The Emmi Group increased sales by 6.2 % to CHF 1,883.6 million in the first half of 2021, with organic growth of 3.7 % exceeding its own expectations. The positive performance is being driven by renewed momentum in the international business, successful brand concepts such as Emmi Caffè Latte and Kaltbach, and growth in strategic niches such as desserts. In the Swiss domestic market, sales declined as expected following a record first six months in 2020 due to the pandemic. The good overall performance with a further improvement in earnings at EBIT and net profit level reflects the robustness of the business model and is a result of the consistent and long-term strategy. The company's positive long-term outlook is strengthened by an expanded sustainability model geared towards a netZERO 2050 agenda. Despite continued uncertainties and rising input costs worldwide, Emmi is adjusting its sales forecast for the full year upwards slightly and confirming its guidance for EBIT and net profit margin.

In brief:

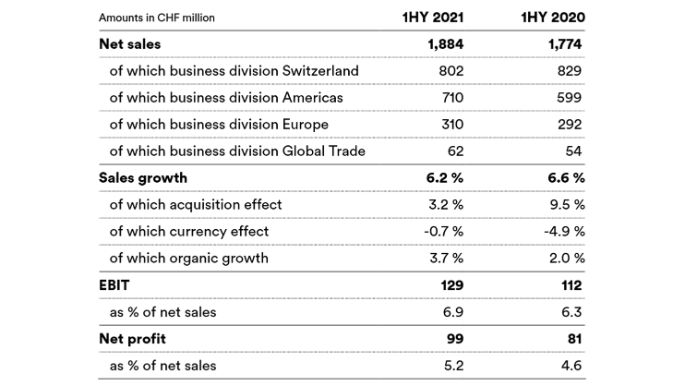

- Total sales growth of 6.2 % or 3.7 % in organic terms (acquisition effect 3.2 %, currency effect -0.7 %)

- All business divisions except Switzerland (-3.3 %) with strong organic sales growth (Americas 11.9 %, Europe 4.9 %, Global Trade 14.3 %)

- Improvement in gross profit margin (36.1 % to 37.2 %) due to organic growth and acquisition of Emmi Dessert USA (formerly Indulge Desserts Group)

- EBIT up +15.5 % (CHF 112.0 million to CHF 129.4 million) and improved EBIT margin (6.3 % to 6.9 %)

- Net profit up +21.4 % (CHF 81.3 million to CHF 98.7 million) and improved net profit margin (4.6 % to 5.2 %)

- Increasing pressure on results in 2HY/2021 due to rising input costs (especially packaging and logistics) and latent interest rate and currency risks

- Improved full-year forecast for the Group’s organic sales growth from the previous range of 1 % to 2 % to a revised 2 % to 3 % due to momentum in the international business

- Confirmation of guidance for EBIT (CHF 275 million to 290 million) and net profit margin (5.2 % to 5.7 %) for full-year 2021

Urs Riedener, CEO of the Emmi Group: "Our proven strategy, which is geared towards sustainable and profitable growth, coupled with the consistent development of our company and product portfolio with strong brand concepts, continues to bear fruit. Overall, we succeeded in growing profitably on a broad basis in a difficult and still volatile environment. While we were able to outperform expectations and post strong growth internationally, as expected business in Switzerland settled at pre-crisis levels following the record first half of 2020, with continued significant losses in the food service and industrial customer businesses. At the same time and against the backdrop of the recent floods and heat waves, our recently revised and expanded sustainability plans – which outline how we intend to develop our business over the long term with respect for nature and future generations – have further gained in importance. For the full year, I am confident that we will achieve our annual targets, which have been adjusted slightly upwards in terms of sales, despite the continuing uncertainties with regard to economic developments and the further course of the pandemic."

Key figures

The overall positive acquisition effect of 3.2 % is due to the following factors:

Positive impact:

- Acquisition of Chäs Hütte Zollikon GmbH (Switzerland, 29 July 2020)

- Acquisition of Emmi Dessert USA (formerly Indulge Desserts Group, USA, 6 October 2020)

Negative impact:

- Sale of Lácteos Caprinos S.A. (Spain, 18 December 2020)

Internal shifts in the distribution channels of individual customers also led to acquisition or divestment effects in the business divisions Americas and Europe. However, these shifts between individual business divisions had no impact on the Group.

Sales performance: strong organic growth in the international business

Emmi took effective advantage of the initial normalisation of the coronavirus situation in key international markets in the first half of 2021 to revive growth momentum and thus achieve good organic sales growth overall. At 3.7 %, this was even higher than the company’s own expectations.

All business divisions contributed to the profitable increase in sales of 6.2 % overall (from CHF 1,773.5 million to CHF 1,883.6 million), albeit to a lesser extent in the Swiss domestic market. Following the record sales achieved in the first half of the previous year due to the pandemic, business at home developed as expected and forecasted more complex.

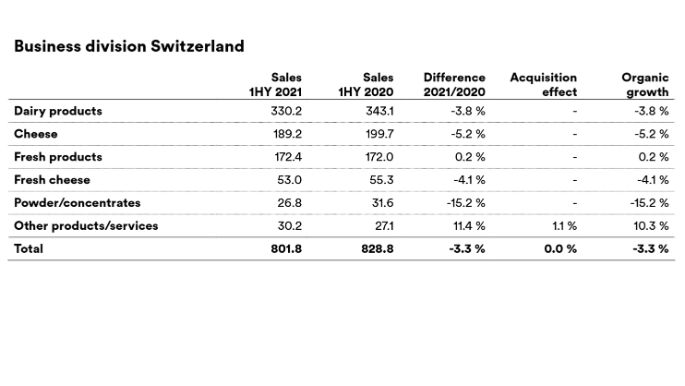

With net sales of CHF 801.8 million (previous year: CHF 828.8 million), the Swiss business saw an organic decline of 3.3 %, primarily on the back of the exceptionally high organic growth in the same period of 2020 (3.8 %). This is mainly attributable to the retail business, which suffered significant setbacks compared to the exceptional previous year driven by pantry loading and border closures. The resurgence of old patterns of consumer behaviour, including shopping tourism, combined with further restaurant closures in some areas and the slow recovery of business with industrial customers, left their mark. The negative effects are particularly visible in the dairy products and cheese segments, which account for the lion's share of sales. On the other hand, brand and speciality concepts – in particular Emmi Caffè Latte and Kaltbach cheese – continued to perform well. The general milk price increase in the current year likewise propped up sales.

The business division Switzerland accounted for 42.5 % of Group sales (previous year: 46.7 %).

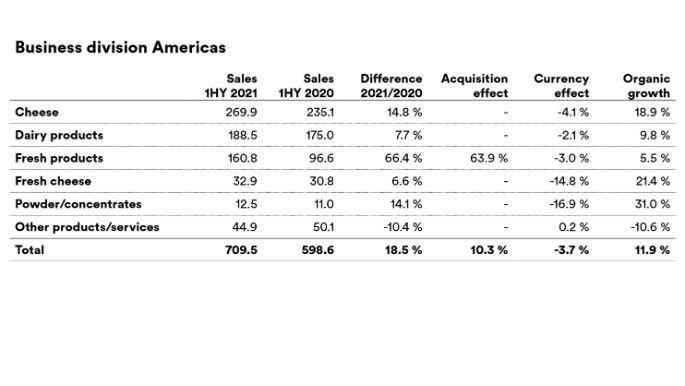

The business division Americas includes the Emmi Group companies in the US, Chile, Spain (excluding Lácteos Caprinos), Tunisia, Brazil, France, Mexico and Canada.

Sales in the business division Americas improved in the first half of 2021 from CHF 598.6 million to CHF 709.5 million. The overall growth of 18.5 % compared with the same period of the previous year is attributable to the acquisition of Emmi Dessert USA, which is developing well, and the high organic growth of 11.9 % (previous year: -1.0 %). Alongside the growth markets of Brazil, Tunisia, Chile and Mexico, this was supported in particular by the recovery of the companies based in the USA, which took a major hit in the previous year due to the coronavirus-related measures implemented in the food service sector.

The business division Americas accounted for 37.7 % of Group sales (previous year: 33.8 %).

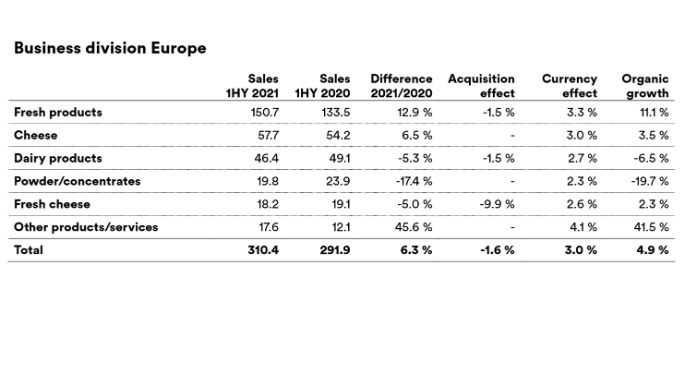

The business division Europe includes the Emmi Group companies in Germany, Italy, the Netherlands, the UK, Austria and Lácteos Caprinos in Spain (sold on 18 December 2020).

Sales in the business division Europe amounted to CHF 310.4 million in the first half of 2021, compared with CHF 291.9 million in the same period of the previous year. This resulted in overall growth of 6.3 %; excluding acquisition and currency effects, organic growth was 4.9 % (previous year: 2.1 %). Strong growth with Emmi Caffè Latte, Italian speciality desserts (both in Fresh products) and vegan products (in Other products/services) was weakened by the negative performance of the Dairy products and Powder/concentrates segments.

The business division Europe accounted for 16.5 % of Group sales (previous year: 16.4 %).

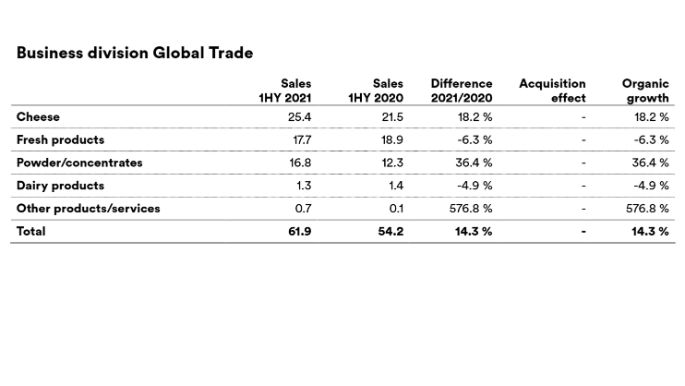

The business division Global Trade primarily comprises direct sales from Switzerland to customers in countries where Emmi has no subsidiaries. These include the Asian and eastern European markets, most South American countries and the Arabian Peninsula.

Sales in the business division Global Trade amounted to CHF 61.9 million in the first half of 2021, compared with CHF 54.2 million in the previous year. This organic growth of 14.3 % (previous year: 2.1 %) is mainly due to a significant increase in exports of skimmed milk powder and higher sales of natural cheese (especially Kaltbach). On the other hand, the slight downturn in the yogurt business continued, for example due to a lack of hotel consumption in the Asian region.

The business division Global Trade accounted for 3.3 % of Group sales (previous year: 3.1 %).

Further details on sales performance can be found in the Financial report of the Emmi half-year report 2021.

Profit performance: consistent upward trend in profitability

Supported by pleasing sales growth, Emmi was able to further strengthen its profitability in the first half of 2021. This was underpinned by the ongoing development of our portfolio of companies and products with strong brand concepts, which remains consistently geared towards sustainable and profitable growth. Particular emphasis was once again placed on our Group-wide efficiency improvement and cost-saving programme Emmi Operational Excellence.

Driven by the positive sales performance, Emmi could significantly increase gross profit of CHF 699.8 million (up 9.4 %) and improve the gross profit margin (37.2 % vs. 36.1 %) for the first half of 2021. This positive margin development is anchored in the consistent execution of the proven strategy, the ongoing development of the company and product portfolio, and a positive effect from the acquisition of Emmi Dessert USA. Measures to increase productivity and streamline procurement were likewise stepped up in the first six months.

Earnings before interest and taxes (EBIT) were CHF 129.4 million in the period under review, up CHF 17.4 million or 15.5 % on EBIT in the previous year (CHF 112.0 million). Driven by the improvement in the gross profit margin described above, the EBIT margin also trended higher, from 6.3 % in the previous year to 6.9 % in the reporting period.

Net profit including minority interests was CHF 107.1 million, compared with CHF 86.8 million in the previous year. After deducting minority interests, net profit was CHF 98.7 million (previous year: CHF 81.3 million). Accordingly, net profit rose by a substantial CHF 17.4 million or 21.4 %. The net profit margin was 5.2 % (previous year: 4.6 %).

Further details on profit development can be found in the Financial report of the Emmi half-year report 2021.

Outlook: head start into a challenging second half of the year

The sales forecast for the full year communicated in March 2021 had largely been exceeded at the half-year mark. The second half of the year remains fraught with major uncertainties, and Emmi does not expect business at all international subsidiaries to normalise until 2022, if at all; this remains subject to setbacks due to the further course of the pandemic. Nevertheless, Emmi expects slightly higher organic growth overall at Group level, in particular due to the positive momentum in the international business. This comes despite a slight deterioration in the outlook for the business division Switzerland, where – as expected – the sales trend in the first six months of the current year was still below the forecast for the full year. This is a result of the exceptional sales growth recorded in the same period of the previous year. However, the broad-based recovery is delayed across all relevant customer groups of Emmi in Switzerland, which is reflected in the adjusted sales forecast for the business division Switzerland.

Emmi confirms the forecasts for EBIT and the net profit margin communicated in March 2021. Rising input costs, for example for packaging materials and in the area of logistics, will have a negative impact on earnings in the second half of the year.

Outlook for full-year 2021

Organic sales performance:

- Group: 2 % to 3 % (previously 1 % to 2 %)

- Business division Switzerland: -2.5 % to -3.5 % (previously -1 % to -2 %)

- Business division Americas: 7 % to 9 % (previously 4 % to 6 %)

- Business division Europe: 3 % to 5 % (previously 1 % to 3 %)

EBIT: CHF 275 million to CHF 290 million

Net profit margin: 5.2 % to 5.7 %

A detailed outlook can be found in the presentation on the Emmi half-year results 2021.

Contacts

For media representatives:

Sibylle Umiker, Head of Media Relations | media@emmi.com | T +41 58 227 50 66

Investor relations:

Ricarda Demarmels, Group CFO | ricarda.demarmels@emmi.com

About Emmi

Emmi is the leading milk processor in Switzerland. The company dates back to 1907, when it was founded by 62 dairy farming cooperatives around Lucerne. Over the past 20 years, Emmi has grown into an international, listed group. It has for many years pursued a successful strategy based on three pillars: strengthening its Swiss domestic market, international growth and cost management. Throughout its corporate history, Emmi’s keen awareness of its responsibility to society, animal welfare and the environment has been fundamental to its mission.

In Switzerland, Emmi manufactures a comprehensive range of dairy products for its own brands and private label products for customers, including leading exports such as Emmi Caffè Latte and Kaltbach. In other countries, its products – mainly speciality products – are manufactured locally. Alongside cow’s milk, it also processes goat’s and sheep’s milk.

In Switzerland, the Emmi Group has 25 production sites. Abroad, Emmi and its subsidiaries have a presence in 14 countries, eight of which have production facilities. Emmi exports products from Switzerland to around 60 countries. Its business activities focus on the Swiss domestic market as well as western Europe and the American continent. Roughly half of its CHF 3.7 billion in sales – about 10 % of which stems from organic products – is generated in Switzerland, the other half abroad and over two-thirds of its around 8,900 employees are based outside of Switzerland.