Result on previous year's level, strategy implementation on track

Emmi made good progress in the first half of 2019 thanks to the consistent implementation of its strategy. The business was further strengthened with a special focus on growth markets and the expansion of the strategic niche areas of desserts, organic products and goat’s milk. At operational level, Emmi held up well despite the difficult environment thanks to strong innovation and the Emmi Operational Excellence cost-saving programme. Organic sales growth of 1.6 % was slightly below expectations, but Emmi is still on track to meet its earnings targets. Compared with (adjusted) prior-year figures, EBIT was slightly down in the first six months of the year, while net profit was slightly up.

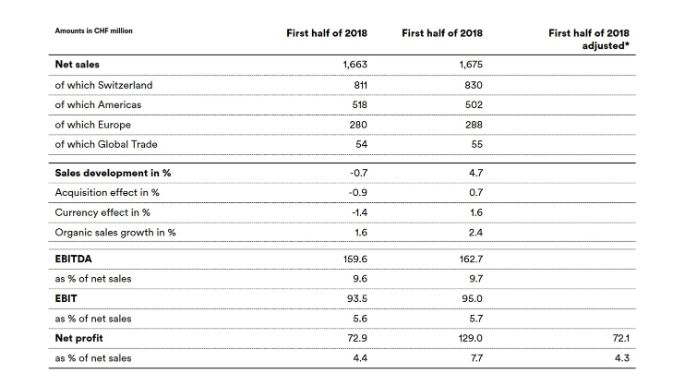

*adjusted by CHF 56.9 million from the sale of the minority stake in Icelandic Milk and Skyr Corporation «siggi’s».

DThe overall negative acquisition effect of 0.9 % is due to the following negative factors:

- Sale of Emmi Frisch-Service AG (Switzerland, 3 April 2019)

- Disposal of part of the trading goods business (Switzerland, 1 January 2018)

A positive factor to note is the purchase of a blue cheese production site (US, 28 February 2019).

Summary

In the first six months of financial year 2019, Emmi achieved modest organic growth of 1.6 % overall. While organic growth in Switzerland was solid at 0.5 % and in the business division Americas on target at 4.3 %, in the business division Europe it fell short of expectations – amounting to 0.7 % overall – due to lower sales at Gläserne Molkerei in Germany. Sales of Emmi Caffè Latte performed very well in all business divisions. Encouraging growth was also posted in strategically relevant niche markets such as Italian dessert specialities and goat’s milk products. Other growth drivers in the first half of 2019 included the growth markets of Chile, Mexico and Tunisia.

In the first half of 2019, Emmi generated EBIT of CHF 93.5 million, a decrease of 1.6 % compared with the previous year (CHF 95 million). Although the gross profit margin rose from 36.1 % to 36.4 % thanks to the consistent focus on the portfolio, the EBIT margin dipped slightly from 5.7 % to 5.6 % due to high cost pressure. This is a remarkable result, given the difficult environment in the sector. Urs Riedener, CEO of Emmi, commented: “We’re seeing once again the importance of the cost-saving programme which Emmi has been constantly expanding for over ten years.” In the end, net profit amounted to CHF 72.9 million – an increase of 1.1 % compared with the (adjusted) prior-year figure of CHF 72.1 million. The net profit margin was 4.4 % (previous year, adjusted: 4.3 %).

Based on the half-year results, Emmi confirms its earnings targets for full-year 2019 (EBIT of CHF 215 million to CHF 220 million and a net profit margin of 4.7 % to 5.2 %), but is slightly lowering its sales forecast for the business division Europe (now: -1.0 % to 1.0 % instead of 1 % to 3 %) and for the Group (now: 1.5 % to 2.5 % instead of 2 % to 3 %).

The systematic implementation of the strategy includes further solidifying the company’s positions in growth markets outside of Europe and investing in strategic niche areas. Emmi took various measures to further this goal in the first half of 2019. In June 2019, Emmi announced its plan to increase its stake in Laticínios Porto Alegre Indústria e Comércio S.A., based in Ponte Nova, Brazil, from 40 % to 70 %. Another area of focus was the expansion of the international goat’s milk network following the announced purchase of a 66 % stake in Austrian organic goat’s milk and sheep’s milk processer Leeb Biomilch GmbH. The strategic Italian dessert business will be further boosted by the purchase of Pasticceria Quadrifoglio S.r.l. The acquisition of the blue cheese production site in the US and the sale of Emmi Frisch-Service AG in Switzerland are also important steps in the implementation of the strategy.

Details of sales and earnings performance

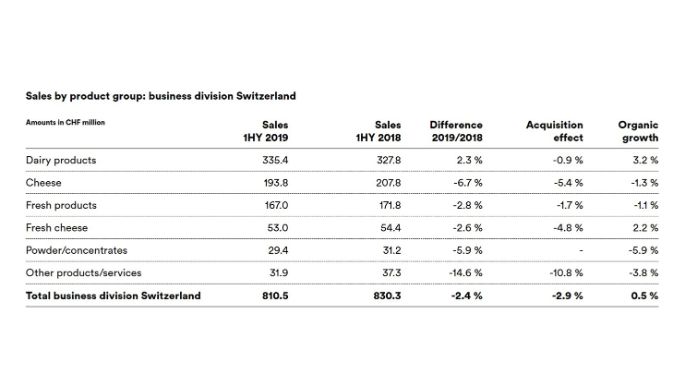

Sales business division Switzerland: at the upper end of expectations

Net sales in the business division Switzerland amounted to CHF 810.5 million, a decline of 2.4 % compared with the previous year’s level (CHF 830.3 million). Adjusted for the abovementioned divestment effects (sale of Emmi Frisch-Service AG, sale of part of the trading goods business), organic growth amounted to 0.5 %, which is at the upper end of the forecasted range published in February 2019 of 0 % to 0.5 % for the year as a whole. The business division Switzerland accounted for 48.7 % of Group sales.

The organic growth in business division Switzerland is primarily due to dairy products. Higher sales volumes of milk and cream more than made up for the decline in butter sales despite ongoing significant price pressure. The two other major product groups, cheese and fresh products, recorded slightly lower sales in organic terms. In the cheese segment, the decline mainly affected cheese varieties. This performance reflects the continued increase in cheese imports compared with the first half of 2018 as well as the general price pressure in this segment. By contrast, various speciality cheeses such as Luzerner Rahmkäse, Scharfer Maxx and Le Petit Chevrier experienced growth. Among fresh products, the organic sales decline was primarily down to losses on private label products of retailers (yogurts and ice cream). Conversely, branded products like Emmi Caffè Latte and Energy Milk posted significant growth.

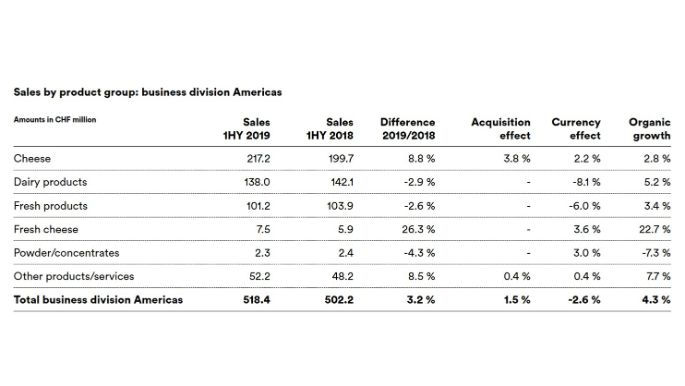

Sales business division Americas: growth driven by Chile, Mexico and Tunisia

The business division Americas comprises the following markets: US, Canada, Mexico, Chile, Tunisia, Spain (excluding Lácteos Caprinos) and France.

Sales in this business division improved over the first six months of 2019 from CHF 502.2 million to CHF 518.4 million, corresponding to growth of 3.2 % year-on-year. In organic terms, i.e. adjusted for currency and acquisition effects, this resulted in growth of 4.3 %. This figure is in line with the full-year forecast from February 2019 (4 % to 6 %). The positive organic sales growth is attributable in particular to the growth markets of Chile, Mexico and Tunisia. The business division Americas accounted for 31.2 % of Group sales.

Organic growth in the cheese segment is mainly due to the Mexideli trade business, Emmi Roth sales of Swiss cheese (e.g. Le Gruyère AOP), the goat’s milk business in the US as well as locally produced cheese in Chile. The dairy products segment posted organic growth of 5.2 %, attributable primarily to the good sales performance in Tunisia (milk, butter) and Chile (milk, cream). Sales of fresh products grew organically by 3.4 %. The positive influencing factors here were sales increases in Italian dessert specialities in France, yogurt and milkshakes in Chile and Kaiku Caffè Latte in Spain. Growth was slowed somewhat by moderate sales of yogurts and yogurt drinks in Spain as a result of market conditions.

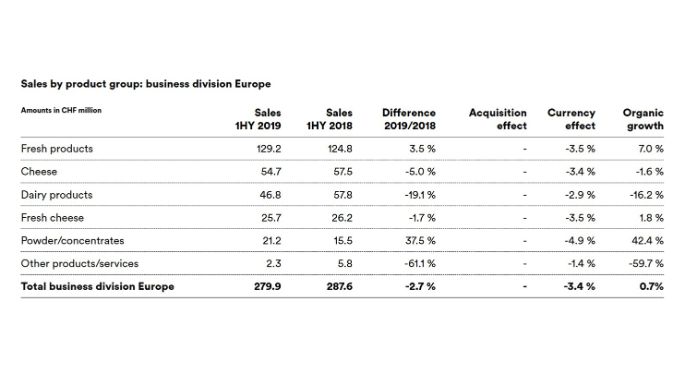

Sales business division Europe: Growth slowed by Gläserne Molkerei

The business division Europe includes Italy, Germany, Austria, Belgium, the Netherlands, the UK and Lácteos Caprinos in Spain.

In the first half of the year, the business division Europe posted sales of CHF 279.9 million compared with CHF 287.6 million in the prior-year period. This corresponds to a decrease of 2.7 %. Excluding the overall negative currency effects, the business division posted slightly positive growth of 0.7 % in organic terms, which is still below Emmi’s forecast for the year as a whole (1 % to 3 %). This result was mainly due to significantly lower sales of dairy products by Gläserne Molkerei in Germany. By contrast, the fresh products and powder/concentrates segments achieved considerable growth when looking at the business division as a whole. The business division Europe accounted for 16.8 % of Group sales.

The fresh products segment posted very pleasing organic growth of 7.0 %. The main drivers of this positive sales growth were Emmi Caffè Latte in all European markets and the Italian dessert specialities business. Meanwhile, sales of Onken yogurts fell in Germany and the UK. Organic sales in the cheese segment dropped 1.6 %. This negative difference was mainly down to a decline in exports of Emmentaler AOP from Switzerland to Italy. Conversely, certain speciality cheeses – such as Kaltbach in Germany – posted very good results. Dairy products experienced a significant organic decline in sales of 16.2 %, which was mainly attributable to a steep drop in sales at Gläserne Molkerei in Germany. This unwelcome development was due to a combination of lower milk volumes processed and generally lower prices for organic milk. Strong organic growth of 42.4 % in the powder/concentrates segment was a result of high sales of goat’s milk powder at trading company AVH dairy and its own production (Goat Milk Powder) in the Netherlands.

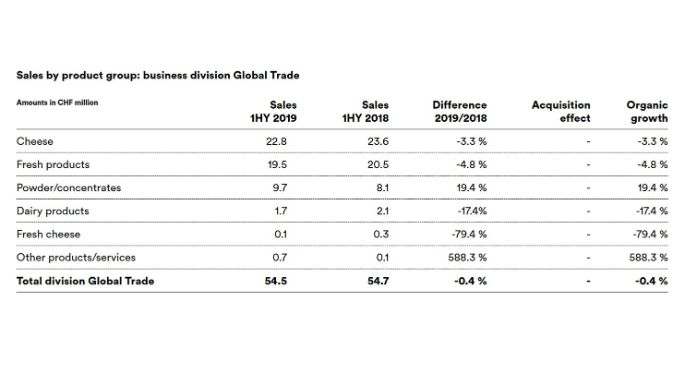

Sales business division Global Trade: sales stable overall

The business division Global Trade primarily comprises direct sales from Switzerland to customers in countries in which Emmi has no subsidiaries. These include the Asian and eastern European markets, most South American countries and the Arabian Peninsula. The business division Global Trade accounted for 3.3 % of Group sales.

Sales in this business division amounted to CHF 54.5 million in the first half of 2019, compared with CHF 54.7 million in the previous year – a decrease of 0.4 %. Decreases in the two important segments of fresh products and cheese are primarily down to lower sales of yogurt drinks and fondue. This is also a result of the renewed strength of the Swiss franc. The increase in the powder/concentrates segment reflects the rise in milk powder exports.

Detailed explanations of the sales performance can be found in the Emmi half-year report 2019.

EBITDA and EBIT margins largely stable

Gross profit amounted to CHF 604.9 million in the period under review (previous year: CHF 604.5 million). This modest increase is particularly positive considering the CHF 11.5 million decline in net sales. Negative currency effects and the overall negative acquisition effects weighed on gross profit. This positive development is attributable to organic growth, especially in the business division Americas. The gross profit margin also rose from 36.1 % to 36.4 %. The focus on strong brand concepts and the systematic implementation of rationalisation and productivity measures once again played a key role in combatting persistently high price pressure from customers.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) decreased by CHF 3.1 million or 1.9 % to CHF 159.6 million (previous year: CHF 162.7 million). The EBITDA margin declined slightly from 9.7 % to 9.6 %, due to the disproportionate increase in other operating expenses compared with sales. The rise in expenses for logistics, energy and operating materials was particularly high. Passing on these costs to customers through higher prices proved to be challenging.

Earnings before interest and taxes (EBIT) were CHF 93.5 million in the period under review, CHF 1.5 million or 1.6 % below the previous year’s EBIT of CHF 95.0 million. The EBIT margin was also slightly lower at 5.6 % compared with 5.7 % in the previous year.

Net profit came in at CHF 72.9 million, an increase of 1.1 % on last year’s figure of CHF 72.1 million (adjusted for the gain from the sale of the minority stake in The Icelandic Milk & Skyr Corporation (“siggi’s”)). The net profit margin was 4.4 % (previous year, adjusted: 4.3 %). Earnings per share were also up, rising to CHF 13.63 in the first six months of 2019 (previous year, adjusted: CHF 13.48).

Outlook for full-year 2019

Based on the half-year results, Emmi confirms its earnings targets for 2019 as a whole (EBIT of CHF 215 million to CHF 220 million and a net profit margin of 4.7 % to 5.2 %). Emmi is, however, slightly lowering its sales forecast for full-year 2019 for the business division Europe (now: -1.0 % to 1.0 % instead of 1 % to 3 %) and for the Group (now: 1.5 % to 2.5 % instead of 2 % to 3 %). The sales forecasts for the business division Switzerland (0 % to 0.5 %) and business division Americas (4 % to 6 %) remain unchanged.

Emmi is bracing itself for a continuing highly competitive environment in the second half of 2019. In Switzerland, price pressure from retailers will remain high. Emmi expects to encounter further risks due to the strength of the Swiss franc and as a result of current political developments. Emmi is robust and well diversified, which will help it to overcome these challenges.

About Emmi

Emmi is a major Swiss milk processor. The company dates back to 1907, when it was founded by 62 dairy farming cooperatives around Lucerne. Over the past 20 years, Emmi has grown into an international, listed group. It has for many years pursued a successful strategy based on three pillars: strengthening its Swiss domestic market, growth abroad and cost management. Throughout its corporate history, Emmi’s keen awareness of its responsibility to society, animal welfare and the environment has been fundamental to its mission.

In Switzerland, Emmi manufactures a comprehensive range of dairy products for its own brands and private label products for customers, including leading exports such as Emmi Caffè Latte and Kaltbach. In other countries, its products – mainly speciality products – are manufactured locally. Alongside cow’s milk, it also processes goat’s and sheep’s milk.

In Switzerland, the Emmi Group has 25 production sites. Abroad, Emmi and its subsidiaries have a presence in 14 countries, seven of which have production facilities. Emmi exports products from Switzerland to around 60 countries. Its business activities focus on the Swiss domestic market as well as western Europe and the American continent. Half of its CHF 3.5 billion in sales – over 10 % of which stems from organic products – is generated in Switzerland, the other half abroad. It has over 6,000 employees who are also spread equally between Switzerland and other countries.

Contacts

Analysts:

Ricarda Demarmels, Group CFO | T +41 58 227 37 98 | ricarda.demarmels@emmi.com

Media:

Sibylle Umiker, Group Communications & IR, Head of Media Relations | T +41 58 227 50 66 | media@emmi.com

Downloads and further information

- Media release (PDF)

- Emmi Online half-year report 2019

- Emmi Sustainability Report (GRI)

- Reports and presentations

- Pictures: Emmi Logo

- Pictures: Emmi Logo am Hauptsitz in Luzern

- Pictures: Emmi Hauptsitz in Luzern

- Pictures: Emmi CEO Urs Riedener (1)

- Pictures: Emmi CEO Urs Riedener (2)

- Pictures: Emmi CFO Ricarda Demarmels

- General pictures