Emmi once again posts a solid set of results

Ad hoc announcement pursuant to Art. 53 LR

Emmi recorded a solid performance again last year, increasing sales to CHF 3,911.9 million. In an environment dominated by the pandemic and rising input costs, growth of 5.6% and organic growth of 3.6% exceeded its own expectations. EBIT saw an adjusted increase of CHF 12.9 million to CHF 284.1 million, while net profit rose by an adjusted CHF 14.1 million to CHF 216.7 million. The positive overall result was driven by a proven strategy, a diversified product range and country portfolio, differentiated and innovative brand concepts, and an agile organisation. To successfully grow its business in the long term, Emmi is also honing its strategy based on its strengths and defining even more clearly what it stands for today and in the future with a new purpose – all with the aim of creating the best dairy moments. For 2022, the leading Swiss dairy company is expecting organic growth of 2.5% to 3.5% and a slight increase in earnings at EBIT level, despite ongoing uncertainties and strong inflationary trends.

Highlights

- Emmi posts organic sales growth of 3.6% (2020: 1.9%), beating its own expectations (2% to 3%); the acquisition effect was 2.3% and the currency effect -0.3%

- EBIT of CHF 284.1 million, up 4.8% on the previous year adjusted for the sale of Lácteos Caprinos S.A.; EBIT margin constant at 7.3%

- Net profit up by 7.0% to CHF 216.7 million compared with the adjusted previous year; net profit margin also steady at 5.5%

- Growth markets strengthened through targeted acquisitions (Athenos feta business, USA, 2021)

and successful further development of strategic niche businesses (Emmi Dessert USA, 2020) - Improvement in the "CDP Climate" rating, with a score 'B' again above the industry average;

Establishment among the leaders in engagement across the entire value chain - Strategy honed building on existing strengths and introduction of an Emmi Purpose:

"Together, we create the best dairy moments – today and for generations to come" - Board of Directors proposes a dividend of CHF 14.00 per share (previous year: CHF 13.00)

- Outlook for 2022: Organic sales growth of 2.5% to 3.5% and a slight increase in EBIT to

between CHF 290 million and CHF 305 million

Urs Riedener, CEO of the Emmi Group, on the annual results: "In 2021, we once again demonstrated that our business model works and that our clear strategic direction is delivering results, with a broadbased product and country portfolio, innovative brands and an agile, locally anchored organisation. I’m particularly pleased that we repeated our success in this exceptional year, steadily strengthening our business and also making further progress in the area of sustainability. To ensure that Emmi continues to grow successfully in the long term and to align our business even more clearly with future growth, we are honing our strategy on the basis of our strengths and introducing an Emmi Purpose. This embodies our passion to carefully produce high-quality dairy products and specialties with respect for nature and people, creating unique moments of indulgence for generations to come.”

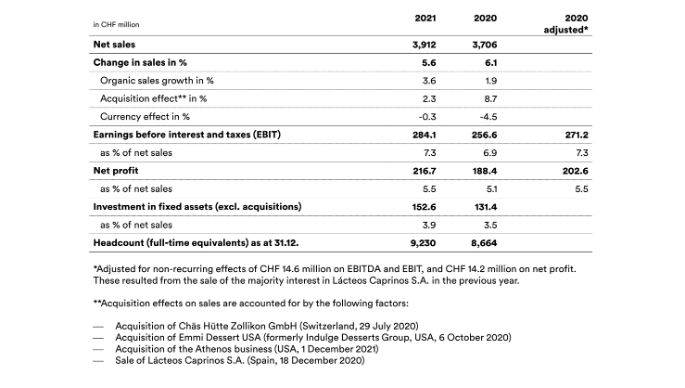

Key figures

Emmi is demonstrating consistency and posting steady growth in an environment constantly beset by challenges. Annual sales are approaching the CHF 4 billion mark and have exceeded its expectations with strong organic growth of 3.6%.

The positive performance confirms the consistent strategic course we have pursued, backed by a diversified portfolio of products and countries, differentiated and innovative brand concepts, and a highly adaptable and efficient organisation with local roots.

While business in Switzerland declined slightly as expected, following the pandemic-related growth in the previous year, momentum continued in the foreign markets and in business in strategic niches such as Italian speciality desserts.

Consolidating strengths and keeping business on track

Brand concepts, especially Emmi Caffè Latte and Kaltbach cheese, also became much more popular among consumers: further proof of Emmi’s ability to set trends with relevant innovations and to translate trends – such as in plant-based nutrition – into growth with successful concepts such as the vegan brand beleaf.

The ongoing work on the Emmi company portfolio also continued to bear fruit. In the US, Emmi’s most important foreign market, the acquisition of the Athenos business, the number 1 in the US feta market, further strengthened the specialty cheese segment, a strategically important mainstay of its business. Emmi Dessert USA, which was acquired in October 2020 in the US – the world’s largest dessert market – and subsequently integrated into Emmi’s international dessert network, also became a growth driver.

At the same time, bottlenecks at suppliers, in logistics and on the employment market, coupled with massively higher raw material, material and energy prices in some cases, also posed considerable challenges for Emmi. Thanks to forward-looking and agile planning, intensified efficiency efforts and regionally integrated supply chains, it was possible to offset some of the additional costs and keep the business on track. Emmi managed to defend its EBIT margin of 7.3% and the net profit margin of 5.5%. In absolute terms, EBIT grew to CHF 284.1 million (+4.8% on adjusted previous year) and net profit to CHF 216.7 million (+7.0% on adjusted previous year).

On track with regards to sustainability

Building on its long-standing traditions and based on the areas of action and objectives defined in the Emmi sustainability model, Emmi has expanded and consolidated its influence in establishing a sustainable dairy industry. In Switzerland, 94% of the milk Emmi processes is now produced according to the swissmilk green sustainability standard. With a view to establishing sustainable milk production abroad, Emmi has also developed scientifically based indicators and launched its first pilot projects.

Further progress was also made in reducing emissions, waste and water consumption in relation to the overall production volume. This was also positively reflected in a further improvement in the CDP climate rating to level ‘B', with this, Emmi continues to perform well above the food industry average and has been recognized as a 'Supplier Engagement Leader' for its commitment towards a sustainable net-zero future across the entire value chain.

Emmi develops proven strategy with a view to future generations

Emmi is also honing its strategy with a view to achieving long-term successful and sustainably profitable growth in its business. Building on its proven and responsible business model, the company now maps future issues and changing needs even more clearly in its strategy.

This now comprises five core elements. These range from strengthening its position in its home market of Switzerland and continuing its focus on international expansion, to consistently developing profitable, clearly defined niche businesses with leading positions in ready-to-drink coffee, specialty cheeses, chilled premium desserts and plant-based dairy alternatives. In addition to these marketrelated elements, excellence in action and sustainability also form part of the updated Group strategy.

Also, the new Emmi Purpose clearly captures what Emmi stands for: "Together, we create the best dairy moments – today and for generations to come." The purpose expresses the passion to carefully produce high-quality dairy products and specialties with respect for nature and people and to create unique moments of indulgence. In conjunction with the strategy, the purpose also outlines how Emmi will develop its business, brands and portfolio over the long term and create added value for all stakeholders.

Sales performance

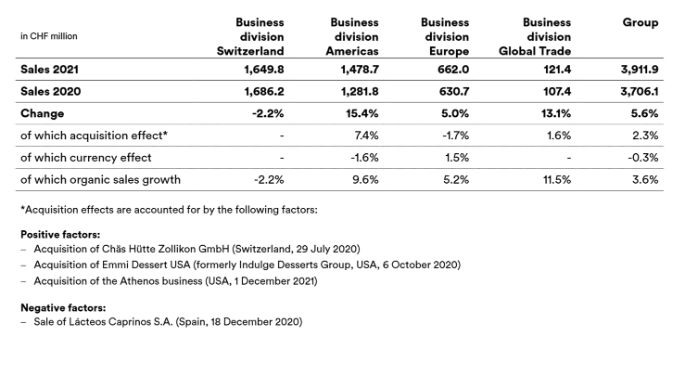

In financial year 2021, Emmi generated net sales of CHF 3,911.9 million (previous year: CHF 3,706.1 million) and growth of 5.6%, despite the challenging environment and a slightly negative currency trend. This comprises organic growth of 3.6%, a positive acquisition effect of 2.3% and a negative foreign currency effect of -0.3%.

The following table provides an overview of sales performance by business division. Details on the sales performance in 2021 can be found in the media release of 26 January 2022 and in the Annual Report 2021.

Key sales figures

Internal shifts in the distribution channels of certain customers also resulted in acquisition or divestment effects in the business divisions Americas, Europe and Global Trade. However, these shifts between individual business divisions did not affect the organic sales performance at Group level.

Profit performance

Gross profit increased by CHF 80.2 million or 5.9% to CHF 1,429.9 million (previous year: CHF 1,349.7 million), which, thanks to a consistent focus on high-margin businesses, also had a positive impact on the gross profit margin of 36.6% (previous year: 36.4%), despite rising input costs and a slightly negative currency effect.

After deduction of personnel expenses of CHF 534.8 million (previous year: CHF 493.8 million) and other operating expenses of CHF 509.5 million (previous year: CHF 484.0 million), earnings before interest, taxes, depreciation and amortisation (EBITDA) amounted to CHF 394.7 million. This represents an increase of CHF 3.8 million on the adjusted previous year (CHF 390.9 million). As a consequence of the slightly higher increase in operating expenses in relation to sales caused by inflation, the EBITDA margin fell from 10.5% in the previous year to 10.1%.

Depreciation and amortisation decreased by CHF 9.0 million to CHF 110.7 million (previous year: CHF 119.7 million), mainly due to higher impairments in the previous year. Earnings before interest and taxes (EBIT) thus increased by CHF 12.9 million or 4.8% from the adjusted prior-year figure to CHF 284.1 million, corresponding to a constant EBIT margin of 7.3%.

Profit including minority interests came to CHF 230.7 million (previous year: CHF 201.6 million), an increase of CHF 29.1 million or CHF 14.9 million on an adjusted basis. The resulting net profit of CHF 216.7 million (previous year: CHF 188.4 million) increased by CHF 28.3 million or CHF 14.1 million after being adjusted for the loss from the sale of Lácteos Caprinos S.A. in the previous year. On an adjusted basis, the net profit margin thus remained constant at 5.5%.

Thanks to this solid overall result, earnings per share increased by 7.0%. The Board of Directors is proposing to the Annual General Meeting to increase the dividend by 7.7% to CHF 14.00 per share.

Outlook

The challenging macroeconomic conditions in many of Emmi’s important markets in recent months, the associated uncertainties, and rising inflationary pressure are likely to persist for some time. The same applies to the costs of raw materials, materials, logistics and energy, some of which are considerably higher than the long-term trend. Compounded by rising wage costs in the international environment, this will put further significant pressure on input costs, which Emmi will counter with sales price increases, but also targeted investments in growth and efficiency gains. However, the pandemic will impact financial year 2022 as well, and business in the food service sector in particular is likely to remain below pre-pandemic levels.

For 2022, Emmi is expecting organic sales growth of 2.5% to 3.5% at Group level, which is slightly above the mid-term expectations (2% to 3%) based on inflation. With the return to earlier consumption patterns and a continuing fiercely competitive market environment with high import and price pressure for dairy products, organic sales growth in business division Switzerland is again expected to be slightly negative (between -1% and 0%). In contrast, in the international business we are expecting continued good growth momentum. Due to inflation, organic sales growth is expected to be above mid-term expectations at 3% to 5% in the business division Europe, and at 6% to 8% in the business division Americas.

At EBIT level, Emmi is expecting an increase in the operating result to between CHF 290 million and CHF 305 million, and a net profit margin of between 5.0% and 5.5%. Emmi is also confirming the medium-term targets for organic growth and the net profit margin.

2022 forecasts

- Organic sales growth Group: 2.5% to 3.5%

- Organic sales growth business division Switzerland: -1% to 0%

- Organic sales growth business division Americas: 6% to 8%

- Organic sales growth business division Europe: 3% to 5%

- EBIT: CHF 290 million to 305 million

- Net profit margin: 5.0% to 5.5%

Medium-term forecasts

- Organic sales growth Group: 2% to 3%

- Organic sales growth business division Switzerland: 0% to 1%

- Organic sales growth business division Americas: 4% to 6%

- Organic sales growth business division Europe: 1% to 3%

- Net profit margin: 5.5% to 6.0%

Emmi will publish its 2022 half-year results on 18 August 2022 at 7.00 am.

Contacts

Analysts

Investor Relations | ir@emmi.com

Medien

Markus Abt, Head of Corporate Communications | media@emmi.com

About Emmi

Emmi is the leading manufacturer of high-quality dairy products in Switzerland. The roots of the company date back to 1907, when it was founded by dairy farmer cooperatives in the Lucerne region. With its focussed strategy, innovative products and internationally established brand concepts such as Emmi Caffè Latte and Kaltbach cheese, the company has developed into an internationally active, listed group (EMMN) with a strong local presence in 15 countries.

In line with its tradition of creating the best dairy moments for generations to come, the careful use of resources and the creation of added value, particularly in rural areas, is part of its business model. Emmi distributes its quality products in around 60 markets and produces high-quality food in 9 countries at over 30 own production sites. With more than 9,000 employees, around 70% of whom work outside Switzerland, the Emmi Group generated sales of CHF 3.9 billion in 2021.