Emmi breaks the 4 billion mark

Ad hoc announcement pursuant to Art. 53 LR

Lucerne, 25 January 2023 - The Emmi Group increased its sales by 8.1% to CHF 4,230.0 million, breaking the 4 billion mark in a challenging environment for the first time. The broad-based and higher-than-expected organic growth of 7.0% reflects the rigorous strategy implementation and differentiated market positions with innovative brand concepts, a diversified geographical presence and a balanced product and customer portfolio. Alongside necessary sales price increases, the positive sales performance was driven by ongoing momentum in international markets, strategic niches such as ready-to-drink coffee with Emmi Caffè Latte or chilled premium desserts, as well as dynamic developments in the Swiss domestic market and the food service business. The Board of Directors of Emmi AG is also proposing Nadja Lang to succeed Alexandra Post Quillet, who will not be standing for re-election at the General Meeting on 13 April 2023.

- Sales growth of 8.1% (2021: 5.6%); organic growth of 7.0%, acquisition effect +2.1%, currency effect -1.0%

- Organic growth in the divisions Americas 13.1%, Europe 6.7% and Switzerland 2.9% and an organic decline for Global Trade -4.4%

- Division Americas: dynamic dessert business in the USA, with Brazil, Mexico and Spain as growth drivers

- Division Europe: ongoing momentum of Emmi Caffè Latte and innovative Italian premium desserts

- Division Switzerland: successful brand concepts as well as recovered momentum in the food service and industry business

- Progress in portfolio transformation with the seamless integration of the Athenos feta speciality range in the focus market USA

- Impairment of non-current assets of around CHF 13 million at Gläserne Molkerei as a result of structural market changes

- Outlook: Adjusted for the aforementioned impairment, EBIT results and net profit margin in line with expectations, at the lower end of the expected range

Emmi will publish its detailed annual results 2022 and outlook for the current financial year at 7.00 a.m. on 1 March 2023.

“With differentiated, innovative brand concepts, a consistent focus on attractive markets and niches, and an enhanced strategy based on our strengths, we can look back on a respectable year buoyed by a significant improvement in the second semester, despite the challenging environment,” comments Ricarda Demarmels, CEO Emmi Group, on the annual sales for 2022.

“Our teams faced the challenging underlying conditions in an exemplary and forward-looking manner with accelerated efficiency programmes and disciplined cost management, while defending volumes and maintaining a focus on local market conditions and further driving sustainability along the value chain.”

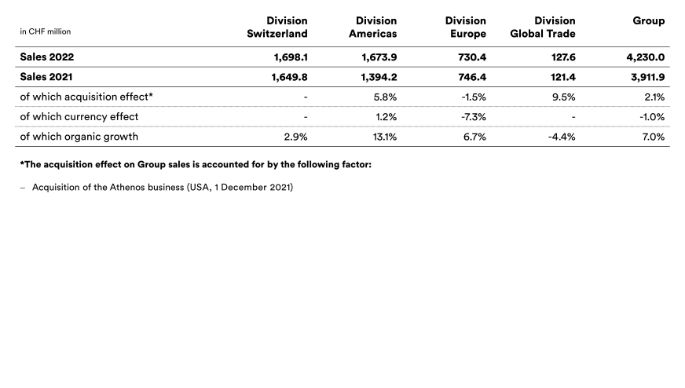

Group sales in 2022: broad-based, organic growth

Emmi generated net sales of CHF 4,230.0 million in 2022 (previous year: CHF 3,911.9 million), exceeding the CHF 4 billion mark for the first time. Sales growth of 8.1% (previous year: 5.6%). This is comprised of organic growth of 7.0%, a positive acquisition effect of 2.1% and a negative foreign currency effect of 1.0%. The price-driven organic growth exceeded own expectations (5% to 6%). With its broad-based geographical presence and a differentiated brand, category and customer portfolio, combined with an enhanced strategy, Emmi successfully weathered the volatile, inflation-driven environment and defended volumes.

International business continues to display high momentum, with organic growth of 13.1% in the division Americas and 6.7% in the division Europe. With organic growth of 2.9%, the performance of the division Switzerland was also positive. In addition to Switzerland, the USA and other key growth markets significantly contributed to organic growth. The division Americas performed especially well when it came to strengthening strategic market positions and attractive niches, as demonstrated by the seamless integration of Athenos' leading feta business in the USA, the most significant foreign and key market for Emmi. In the division Europe, too, momentum remained strong for differentiated brand concepts such as Emmi Caffè Latte or innovative Italian speciality desserts. In the Swiss domestic market, key brands such as Emmi Caffè Latte or Emmi Energy Milk continued to stand out, and the recovery of the food service business and industry sales also had a positive effect.

In terms of strategic niches, Emmi Caffè Latte in the area of ready-to-drink coffee confirmed the ongoing momentum in all European markets as well as in Switzerland. In the case of chilled premium desserts, the business in the USA and in Italy continued to grow, while for plant-based milk alternatives, the vegan brands Beleaf in Switzerland and Begetal in Spain further reinforced their presence. On the other hand, the speciality cheese business in the counter segment contracted in Europe due to declining consumer sentiment in many countries coupled with rising product prices due to the strong Swiss franc.

Key sales figures

Sales by division: strong brand concepts in strategic niches

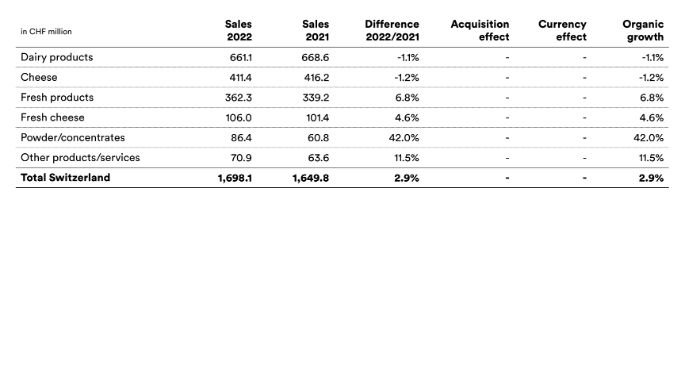

The division Switzerland generated sales of CHF 1,698.1 million in 2022 (previous year: CHF 1,649.8 million), which corresponds to growth of 2.9%. Factors that contributed to the organic growth exceeding own expectations (0.5% to 1.5%) following the pandemic-related decline in sales included the recovery of the food service business as well as industry sales, in particular milk powder. Unavoidable sales price increases as a result of higher milk prices benefiting milk producers as well as the sharp rise in input, energy, logistics and packaging costs also contributed to increased sales. The Emmi Caffè Latte and Emmi Energy Drink brands continued to enjoy great popularity, and the vegan brand Beleaf was also able to expand its base further. The anticipated decline in volumes in the retail business as a result of normalisation of the figures seen in the previous year shaped by the pandemic is primarily reflected in the dairy products and cheese segments. The division Switzerland accounted for 40.1% of Group sales (previous year: 42.2%).

Sales by product group: division Switzerland

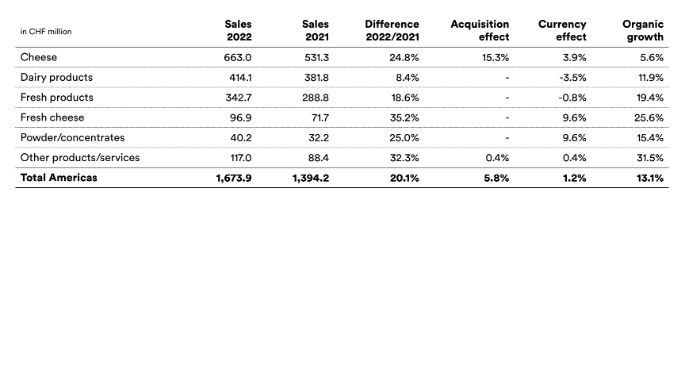

The division Americas generated sales of CHF 1,673.9 million (previous year: CHF 1,394.2 million), which corresponds to strong growth of 20.1%. Spain and the US business significantly increased their sales alongside the growth markets Brazil, Mexico and Chile. Organic growth exceeded own expectations (10% to 12%) at 13.1%, attributable particularly to the continued dynamic with innovative speciality desserts from Emmi Dessert USA and Emmi Caffè Latte in Spain. The acquisition effect is due to the successful integration of Athenos and its leading feta range in the USA into Emmi Roth in the strategic speciality cheese segment. A key driver of the positive performance in the dairy products segment is UHT milk from an additionally commissioned production facility in Brazil in 2021. In other products/services, Mexideli’s trading goods business delivered strong results, as did plant-based milk alternatives in the USA. The division Americas accounted for 39.6% of Group sales (previous year: 35.6%).

Sales by product group: division Americas

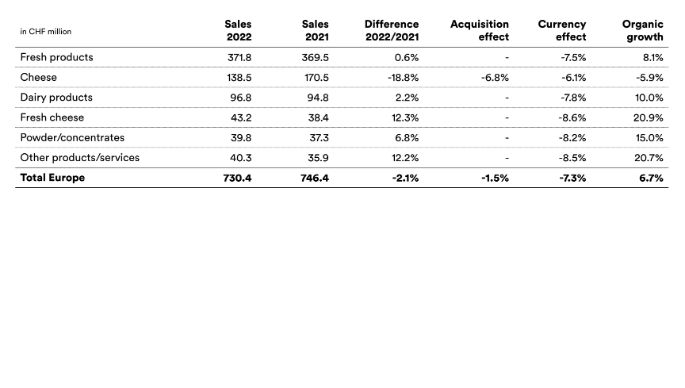

In the division Europe, sales decreased from CHF 746.4 million to CHF 730.4 million, corresponding to a decline of 2.1%. Adjusted for acquisition and currency effects, organic growth was in line with own expectations (6% to 8%) at 6.7%. This is attributable to the continued positive performance of Emmi Caffè Latte in all European markets and innovative Italian speciality desserts in the fresh products segment. Sales of fresh goat cheese at Bettinehoeve in the Netherlands also rallied. The strong negative currency effects resulted from the appreciation of the Swiss franc against the euro and the British pound. The negative acquisition effects were caused by shifts in the distribution channels of certain customers in the divisions Europe and Global Trade. Lower sales of Swiss speciality cheese in Germany, Italy and the Netherlands led to an organic decline in the cheese segment. The division Europe accounted for 17.3% of Group sales (previous year: 19.1%).

Sales by product group: division Europe

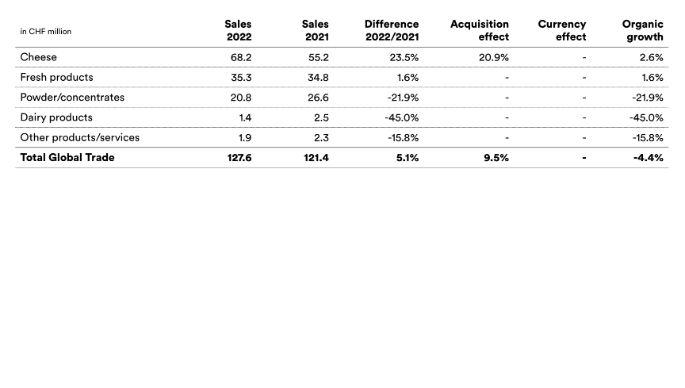

The division Global Trade recorded sales of CHF 127.6 million (previous year: CHF 121.4 million), corresponding to a growth of 5.1% or an organic decline of 4.4%. The organic growth in the fresh products segment is attributable to rising yogurt sales in the Asian region. On the other hand, the anticipated normalisation of the high exports of surpluses of skimmed-milk powder as a result of the pandemic, led to a decrease in sales. The division Global Trade accounted for 3.0% of Group sales (previous year: 3.1%).

Sales by product group: division Global Trade

Board of Directors sends message of continuity

The Board of Directors of Emmi AG is proposing Nadja Lang to succeed Alexandra Post Quillet, who will not be standing for re-election at the General Meeting on 13 April 2023. Emmi regrets and respects the decision made by Alexandra Post Quillet, an esteemed member of the Board of Directors. With her extensive expertise and competence in the food industry, particularly at an international level, Alexandra Post Quillet has made a considerable contribution towards the positive development of Emmi.

The Board of Directors firmly believes that Nadja Lang, with her proven competence on a strategic and operational level in the areas of consumer goods, retail, gastronomy and sustainability, will ideally complement Emmi’s nine-member Board. The Board will continue to consist of four women and five men.

At the same time, the Board of Directors has confirmed the nomination of Urs Riedener as Chairman and successor to Konrad Graber, who will not be standing for re-election at the General Meeting on 13 April 2023. By doing so, the Board is sending a message of continuity in leadership and the strategic direction of the company as well as the corporate culture.

Market changes lead to an impairment at Gläserne Molkerei

Emmi is countering the historically high input, energy and logistics costs and the ongoing economic implications with disciplined and networked purchasing and cost management, accelerated excellence and efficiency programmes, and necessary sales price adjustments. However, inflation and the resulting loss of purchasing power has impacted consumer sentiment in several markets. The market for organic dairy products in Germany has been hit particularly hard, which has led to structural market changes. This development placed a further strain on the business performance of Gläserne Molkerei and clouded its future prospects over the medium term, leading to an impairment of non-current assets in the amount of around CHF 13 million.

Outlook: adjusted for the aforementioned impairment, results in line with expectations, at the lower end of the range

For the financial year 2022, as expected, Emmi projects earnings before interest and taxes (EBIT), adjusted for the aforementioned impairment, to be at the lower end of the range communicated at the end of the first half of the year (CHF 265 to 280 million). The net profit margin, adjusted for the impairment, is also expected to be at the lower end of the range (4.5% to 5.0%).

Emmi will publish its detailed annual results 2022 and outlook for the current financial year at 7.00 a.m. on 1 March 2023.

Downloads and further information

- Media release as PDF

- Media release on half-year results 2022

- Alternative performance measures (APM)

- General images relating to Emmi

- Image of Nadja Lang

- CV of Nadja Lang

Further reports and presentations are available in the Emmi download center.

Contacts

Media

Simone Burgener, Media spokesperson | media@emmi.com

Investors and analysts

Ricarda Demarmels, CEO | ir@emmi.com

About Emmi

Emmi is the leading manufacturer of high-quality dairy products in Switzerland. The roots of the company date back to 1907, when it was founded by dairy farmer cooperatives in the Lucerne region. With its focused strategy, innovative products and brand concepts established in Switzerland and beyond, such as Emmi Caffè Latte and Kaltbach cheese, Emmi has grown into an internationally active, listed group (EMMN) with a strong local presence in 14 countries.

Emmi’s business model is traditionally based on a careful approach to nature, animals and people. In this way, Emmi creates the best dairy moments, today and for generations to come, while also contributing to value creation in rural regions. The company distributes its quality products in around 60 countries and manufactures these at around 50 of its own production sites in eleven countries. With more than 9,000 employees, around 70% of whom work outside Switzerland, the Emmi Group generated sales of CHF 4.2 billion in 2022.