Emmi demonstrates reliability, strategy is on track

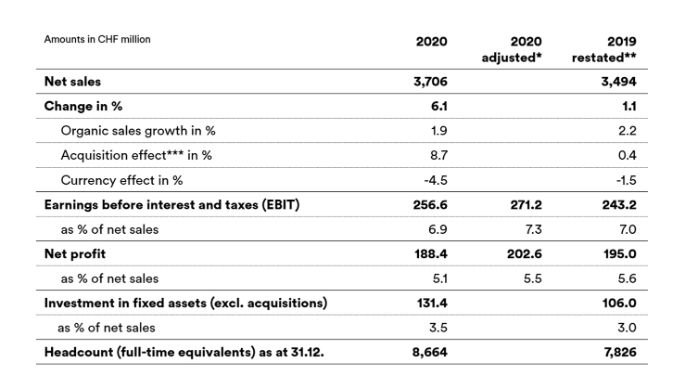

Emmi increased its sales by 6.1 % to CHF 3,706 million in a challenging 2020, surpassing its own expectations with broad-based organic growth of 1.9 %. The improved EBIT performance – up 5.5 % to CHF 256.6 million, or 11.5 % to CHF 271.2 million after adjustment for non-recurring effects – reflects Emmi’s robust business model and consistent strategy implementation. Net profit was CHF 188.4 million (-3.4 %), or CHF 202.6 million on an adjusted basis (+3.9 %). Contributing factors behind this good performance included the strong brands business and the company’s activities in strategic niches. Emmi also made further progress towards achieving its sustainability targets. For example, 93 % of the milk that Emmi processes in Switzerland is already produced according to the «swissmilk green» sustainability standard. Despite continuing uncertainties, Emmi expects organic growth of 1 % to 2 % and slightly higher EBIT in 2021.

Highlights

- Group sales record organic growth of 1.9 %, exceeding Emmi’s own forecast (0.5 % to 1.5 %); the acquisition effect was 8.7 % and the currency effect -4.5 %.

- EBIT up 5.5 % year on year at CHF 256.6 million; EBIT margin of 6.9 %. Adjusted for the non-recurring effect from the sale of Lácteos Caprinos S.A., EBIT totalled CHF 271.2 million (+11.5 %) and the EBIT margin was 7.3 %.

- Net profit fell by 3.4 % to CHF 188.4 million (net profit margin 5.1 %); the adjusted figure rose by 3.9 % to CHF 202.6 million (adjusted net profit margin 5.5 %).

- Position in niches and emerging markets strengthened through acquisitions in 2019 and 2020.

- Further progress in terms of sustainability: CO2 reduction -24 %* (target: -25 %), 93 % sustainable Swiss milk (target: 100 %), waste and food waste -10 %* (target: -20 %), 63 %* of employees have a personal development plan (target: 100 %)

- The Board of Directors is proposing a dividend of CHF 13.00 per registered share (previous year: CHF 12.00).

- Outlook for 2021: stable organic sales growth of 1 % to 2 % and slightly higher EBIT (CHF 275 million to CHF 290 million)

* Provisional target attainment values as at the end of 2020

“The pleasing results are a vindication of our choice to rigorously pursue our strategic course and further build on our proven business model with a diversified product and country portfolio and crisis-resistant brand concepts. Our success in continuing to grow profitably during this extraordinary year, despite tough operating conditions and substantial setbacks in the food service business, also bears testament to the tremendous dedication of our employees and the resilience of our organisation. What is more, because our long-term success is closely bound up with nature, we have committed not just to keep lowering our own carbon footprint further but also to extend this ambition to our entire value chain and aim for net-zero emissions,” said Emmi Group CEO Urs Riedener.

Key figures

* Adjusted for non-recurring effects of CHF 14.6 million on EBITDA and EBIT or CHF 14.2 million on net profit. In the period under review, these resulted from to the sale of the majority stake in Lácteos Caprinos S.A. There were no significant non-recurring effects in the previous year.

** Prior-year figures restated based on the changes to the consolidation and valuation principles with respect to goodwill.

*** Acquisition effects on sales are accounted for by the following factors:

+ Acquisition of a blue cheese production site (US, 28 February 2019)

+ Acquisition of Leeb Biomilch GmbH and Hale GmbH (Austria, 8 October 2019)

+ Acquisition of Laticínios Porto Alegre Indústria e Comércio S.A. (Brazil, 24 October 2019)

+ Acquisition of Pasticceria Quadrifoglio S.r.l. (Italy, 31 October 2019)

+ Merger of Surlat and Quillayes (Chile, 15 January 2020)

+ Acquisition of Chäs Hütte Zollikon GmbH (Switzerland, 29 July 2020)

+ Acquisition of Indulge Desserts Group (US, 6 October 2020)

- Sale of Emmi Frisch-Service AG (Switzerland, 3 April 2019)

- Sale of Lácteos Caprinos S.A. (Spain, 18 December 2020

Emmi is navigating a steady and reliable path through the crisis. Group sales exceeded CHF 3.7 billion for the first time, of which more than CHF 2.0 billion was generated outside of Switzerland. The positive sales performance confirms the robustness of Emmi’s business model, the well-balanced nature of the product and country portfolio, and the organisation’s adaptability.

In the interests of its long-term success, Emmi stepped up its strict cost management last year and also made targeted, value-creating investments in order to strengthen its innovation and growth plans for the long run. These included starting construction of a new cheese dairy in Emmen and building a state-of-the-art production facility in Brazil. Systematic optimisation of Emmi’s company portfolio is also an investment in the future. For example, the acquisition of American Indulge Desserts not only gave Emmi its own presence in the world’s largest dessert market, but also created additional distribution opportunities and economies of scale for the global dessert business. Elsewhere, the majority stake in Lácteos Caprinos was sold in order to focus resources on high-growth, high-margin companies.

Emmi also set other clear priorities alongside cost management during the crisis: to protect employees, safeguard security of supply and pursue new sales opportunities. This clear concept kept Emmi on track through the global crisis, enabling it to meet its 2020 targets for both EBIT (CHF 256.6 million) and the net profit margin (5.1 %), and in fact slightly exceed them after adjustment for the non-recurring effect described above.

Emmi also forged ahead with its sustainability activities in 2020 and set ambitious new targets to be achieved by 2027. Emmi is on track with its goal of fully switching to sustainably produced milk. In Switzerland the share of milk produced in accordance with the «swissmilk green» standard has risen to 93%. Emmi is working with its milk producers to close the remaining gap by 2023. At the same time, work has started on drawing up a catalogue of criteria for milk processed outside of Switzerland. Good progress was also achieved across the group in terms of reducing greenhouse gas emissions, which fell by 24 % in comparison with the base year 2014. Further efforts are needed, however, when it comes to waste reduction. Although food waste has been reduced by 10 % in comparison with the base year 2017, progress is lagging behind expectations due to problems with the recycling of individual waste products at our Tunisian subsidiary Vitalait. In some countries and areas there are also still gaps in formulating development plans for employees (currently 63 %).

Emmi has now also set specific global reduction targets for water consumption for the first time and is working towards closed packaging cycles. In a further pioneering step, Emmi is not just incrementally reducing its own carbon footprint, but also extending that ambition to aim for zero net emissions along the entire value chain.

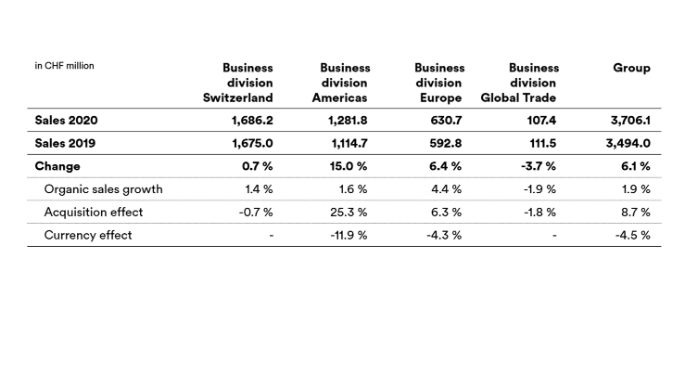

Sales performance

Despite the global turmoil and negative foreign-exchange trends, Emmi generated net sales of CHF 3,706.1 million in 2020 (previous year: CHF 3,494.0 million) and growth of 6.1 %. This is comprised of organic growth of 1.9 %, a positive acquisition effect of 8.7 % and a negative currency effect of 4.5 %.

The following table provides an overview of sales performance by business division. More detailed information on Emmi’s sales performance in 2020 can be found in the media release dated 28 January 2021 or the Annual Report 2020.

Profit performance

Gross profit increased from CHF 1,266.6 million to CHF 1,349.7 million in the year under review. The gross profit margin rose slightly, from 36.3 % to 36.4 %, despite the trend towards basic products during the coronavirus crisis. This underlines the resilience of Emmi’s business model. After taking into account personnel expenses of CHF 493.8 million (previous year: CHF 462.4 million), other operating expenses of CHF 484.0 million (previous year: CHF 458.3 million) and other operating income of CHF 4.5 million (previous year: CHF 6.9 million), earnings before interest, taxes, depreciation and amortisation (EBITDA) rose by CHF 23.4 million to CHF 376.3 million, compared with CHF 352.9 million in the previous year. Adjusted for the above-mentioned non-recurring effect, EBITDA for the year under review was CHF 390.9 million. The adjusted EBITDA margin was thus increased from 10.1 % in the previous year to 10.5 %, thanks in part to rigorous cost management.

After taking into account depreciation and amortisation of CHF 119.7 million (previous year: CHF 110.0 million), earnings before interest and taxes (EBIT) of CHF 256.6 million, or CHF 271.2 million excluding the non-recurring effect described above, were recorded in the year under review. On an adjusted basis, EBIT rose by CHF 28.0 million or 11.5 % (previous year: CHF 243.2 million). The adjusted EBIT margin therefore increased from 7.0 % in 2019 to 7.3 % in 2020.

Profit including minority interests was CHF 201.6 million; adjusted for the above-mentioned non-recurring effect, the figure was CHF 215.8 million (previous year: CHF 204.0 million). The marked increase in minority interests in profit from CHF 9.0 million in the previous year to CHF 13.2 million in 2020 is a positive sign, even if it dented net profit. It shows that companies with minority interests increased their profitability overall in the period under review. This ultimately resulted in net profit of CHF 188.4 million, or CHF 202.6 million on an adjusted basis (previous year: CHF 195.0 million), in the 2020 financial year. The adjusted net profit margin therefore fell marginally from 5.6 % in the previous year to 5.5 % in the year under review. The year-on-year rise in the EBIT margin was not replicated at net profit level due to expected increases in financing expenses, income taxes and minority interests, coupled with the proportional loss from associates.

Based on the good earnings, the Board of Directors is proposing a dividend of CHF 13.00 per registered share to the General Meeting, which represents an increase of CHF 1.00 on the previous year.

Outlook

The uncertainties triggered by coronavirus, coupled with fears about economic development in the key markets where Emmi operates and the ongoing price pressure for dairy products in its domestic market, are shaping the outlook for the current year. The forecasts for Emmi’s business performance in the current year are based on the assumption that the situation will stabilise in those markets that are relevant for Emmi from the second quarter of 2021 onwards, but that the overall environment will only normalise starting in 2022. Under these circumstances, organic sales growth at Group level in 2021 is likely to be similar to 2020 (1 % to 2 %). Sizeable fluctuations in sales must be expected, however, depending on how long the crisis lasts, and certainly should be anticipated until midway through the year.

Emmi is expecting a decline in its Swiss domestic market. The continuing import and price pressure on dairy products, combined with predictions of a gradual return to previous patterns of consumption, look set to translate into a 1 % to 2 % decrease in sales. In the business division Europe, similar reasons are likely to result in a slowdown in sales growth (1 % to 3 %). Conversely, in the business division Americas, which was hit hard by the coronavirus crisis, the recovery that had already begun in some places in the fourth quarter of 2020 is likely to accelerate, making the business division a growth driver again (4 % to 6 %). Continuity is also expected for EBIT performance (CHF 275 million to CHF 290 million) and for the net profit margin (5.2 % to 5.7 %).

2021 forecasts

- Sales Group: 1 % to 2 %

- Sales business division Switzerland: -2 % to -1 %

- Sales business division Americas: 4 % to 6 %

- Sales business division Europe: 1 % to 3 %

- EBIT: CHF 275 million to CHF 290 million

- Net profit margin: 5.2 % to 5.7 %

Medium-term forecasts

- Sales Group: 2 % to 3 %

- Sales business division Switzerland: 0 % to 1 %

- Sales business division Americas: 4 % to 6 %

- Sales business division Europe: 1 % to 3 %

- Net profit margin: 5.5 % to 6.0 %

Contacts

Analysts:

Ricarda Demarmels, CFO

T +41 58 227 37 98 | ir@emmi.com

Media:

Sibylle Umiker, Spokesperson, Corporate Communications

T +41 58 227 50 66 | media@emmi.com

About Emmi

Emmi is a major Swiss milk processor. The company dates back to 1907, when it was founded by 62 dairy farming cooperatives around Lucerne. Over the past 20 years, Emmi has grown into an international, listed group (ticker: EMMN). It has for many years pursued a successful strategy based on three pillars: strengthening its Swiss domestic market, international growth and rigorous cost management. Throughout its corporate history, Emmi’s keen awareness of its responsibility to society, animal welfare and the environment has been fundamental to its mission.

In Switzerland, Emmi manufactures a comprehensive range of dairy products for its own brands and private label products for customers, including leading exports such as Emmi Caffè Latte and Kaltbach. In other countries, its products – mainly speciality products – are manufactured locally. Alongside cow’s milk, it also processes goat’s and sheep’s milk.

In Switzerland, the Emmi Group has 25 production sites. Abroad, Emmi and its subsidiaries have a presence in 14 countries, eight of which have production facilities. Emmi exports products from Switzerland to around 60 countries. Its business activities focus on the Swiss domestic market as well as Western Europe and the American continent. Roughly half of its CHF 3.7 billion in sales – around 10 % of which stems from organic products – is generated in Switzerland, the other half abroad. More than two-thirds of its nearly 8,700 employees now work at locations outside of Switzerland.